CAN SOMEBODY PLEASE SUPPLY A…

CAN SOMEBODY PLEASE SUPPLY A BLOOMBERG TERMINAL TO @Brad_Setser RIGHT NOW!!!!! WHEREVER HE IS. SERIOUSLY. https://t.co/LqlR7iADPU

CAN SOMEBODY PLEASE SUPPLY A BLOOMBERG TERMINAL TO @Brad_Setser RIGHT NOW!!!!! WHEREVER HE IS. SERIOUSLY. https://t.co/LqlR7iADPU

One dynamic that pushed the dollar up in the 2008 crisis: foreign investors who has borrowed dollars to buy MBS saw… https://t.co/liZH6tWpPw

I used to call 2008 a heart attack because we were so centered on banks. I’m wondering what medical analogy to use… https://t.co/MvqtjOsnNx

14 m laid off due to corona: Can this be correct? If these numbers are even remotely right, it is the most savage… https://t.co/69mOMzAXG5

.@IrvingSwisher @BuddyYakov et al are right. The Fed is going to have to do American OMT and backstop munis.

So, obviously we’ve been thinking about it, and talking about in a throwaway kind of way, but did anyone really ima… https://t.co/L0auipijVy

Global dollar shortage is reflected in cross-currency basis swap spreads which track the premium that market partic… https://t.co/bXyNYzJujJ

The macroeconomic effect of the microeconomic search for liquidity is a surge in the dollar that squeezes the entir… https://t.co/sxgDaR7UK1

I have to say that when I first saw this uniform I did not immediately think … hey that is the police president of… https://t.co/5paCsX3T5E

"U.S. primacy has come under strain from a rising China. In 1990, the country was a geopolitical afterthought: its… https://t.co/uVK3gwv5LI

BRACE for the release of this week’s labour market data next week. It is going to be a horrifying shock. https://t.co/odoNVW8yJd

The shutdown of the US economy is taking on extraordinary proportions. More people are losing their jobs in a singl… https://t.co/usUTJEk1xc

@zeithistoriker @I_had_a_tweet @StephenKMackSD Only a holding note … then spent best part of a month cogitating and… https://t.co/Ze37QdtGeE

Everything about US markets has been bonkers: VIX, correlations, speed of sell off, trading volumes. All data via… https://t.co/35VI3t6Bwc

Wonderful thread of great essayistic writing! Thank you @colinmarshall https://t.co/xG5BzYvUPm

As expected, the FED announced a third liquidity facility, this one related with Money Market Funds. The playbook o… https://t.co/xJxftPBA2o

The pushback begins! Nameless “policy makers” at ECB are "unhappy that this week’s emergency bond-buying plan cou… https://t.co/5tiGGWUy7H

“Totally broken” – State unemployment websites around US are crashing because of high traffic from workers suddenly… https://t.co/JnoSzKnqxZ

In Pennsylvania, 121k people filed unemp claims Monday-Wednesday this week. Nothing in 2008-09 recession came even… https://t.co/Lcmfd7maCj

“The system isn’t really designed for an onslaught like this” Will US labour offices cope with HUGE wave of job lo… https://t.co/9dCfkoBR6j

In the pile of corporate debt we are worried about, to my surprise, it is European car makers who faced the most se… https://t.co/25R825capc

ECB "is now at last making good on her predecessor Mario Draghi’s promise to do “whatever it takes”. It was always… https://t.co/p08pA7Hp8z

@DimitarBechev Quarantine at Sculeni (border between Ottoman Moldavia & Russian Bessarabia, today between Romania &… https://t.co/LBwYX9TANm

Europe’s huge car industry is shutting down. https://t.co/JioQdHRcmJ US unions and employers reached deal to shut… https://t.co/16nStwiHPk

Significant relief for South Korean won after swap line announcement. https://t.co/AS66RexJu4 https://t.co/Wqnuk85dU3

Brazilian Real recovers somewhat after swap line news. https://t.co/8xG8j1oZOB https://t.co/DcjN0rgSzg

“It was six months in one day” – how virus time & financial market time are intersecting as Brazilian currency plum… https://t.co/KptIcttNnT

The longest economic expansion in US history lasted 11 years from June 2009 to March 2020. It is now over.… https://t.co/b7jlEWpCBL

So swap lines are now up for all economies that were connected in 2008 including $60bn for central banks of Austra… https://t.co/s86RcAOAHI

This piece from @spiegelonline on 17 March … is like news from another world. Journalist notes that Italian hospita… https://t.co/fgj7khTuId

In 2008 the crisis in prime money market funds tipped Wall Street over the edge. The outflows are serious now too.… https://t.co/eIZz8Ki1zD

A timeline of the Wuhan outbreak and the early cover up, when vital weeks were lost with useful references.… https://t.co/YqdXBx4ecb

Following oil crash, energy now has the 2nd smallest sectoral weighting in the S&P500! Keep on like this and disinv… https://t.co/1fp63p4KcN

"acute corporate balance-sheet stress, cash repatriation by global investors, disruption to trade and hidden losses… https://t.co/4VR3jwyzqp

Need $? As investors flee into dollars and currencies across Asia and Europe are crushed, the issue of dollar liqui… https://t.co/P5t8xozAmx

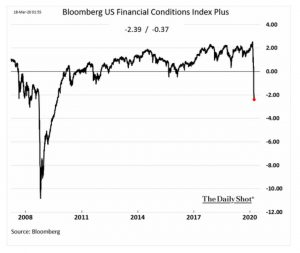

Financial conditions are tightening in the US in a way not seen since 2008. Data from @SoberLook https://t.co/WOrKv5UPdR

© 2025 Adam Tooze. All Rights Reserved. Privacy policy. Design by Kate Marsh.