|

In the US this week an argument flared about the continuation of Fed emergency programs and their cancelation by outgoing Trump Treasury Secretary, Steve Mnuchin. In Europe the much-hailed July recovery package was stalled by Europe’s own nationalist-populist troublemakers aka Hungary and Poland. In both cases this leaves the central banks exposed and increasingly politicized. Meanwhile, the G20 is holding a virtual meeting under Saudi chairmanship (sic) to discuss a framework for addressing international debts of lower income countries. 1. Stalling in November In a piece in Foreign Policy I connect the dots between the impasse in Europe and the in-fighting in the United States over the extension of the Fed’s emergency relief programs.

The West’s Constitutional Crises Threaten the Economy’s Last Best Hope The unused funds in the Fed programs were being eyed by the Dems as a possible supplement to the inadequate fiscal stimulus they will be able to negotiate with McConnell.

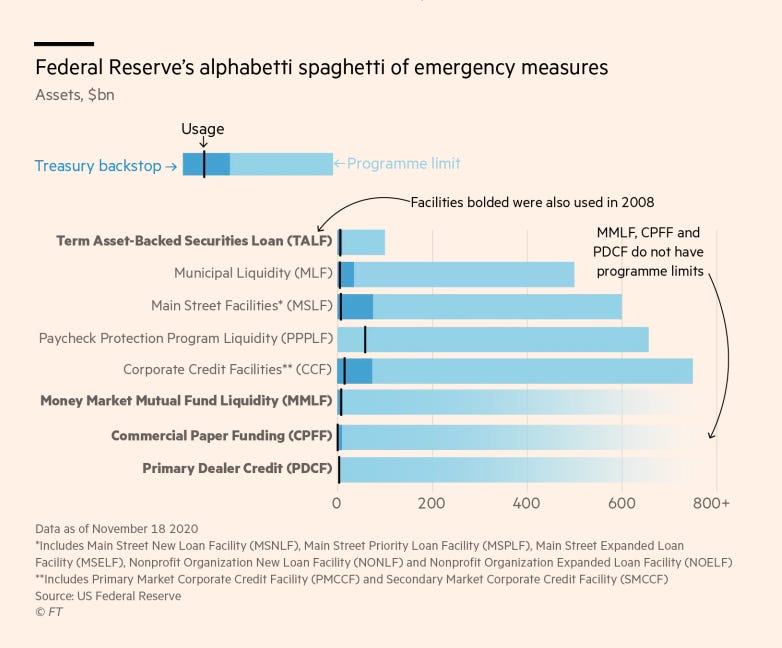

Source: FT Mnuchin wants the funds transferred from the Fed and put at the disposal of Congress which is not a recipe for action because a further round of fiscal stimulus is deadlocked there. The Dems, reasonably in my view, suspect this is part of the tactics of scorched earth and narrowing the room for maneuver of a Biden administration we see in other areas of government. It is part, therefore, of the unprecedented refusal to cooperate in the handover of power that is fundamental to the functioning of the American political system. Strikingly the Chamber of Commerce thinks so too:

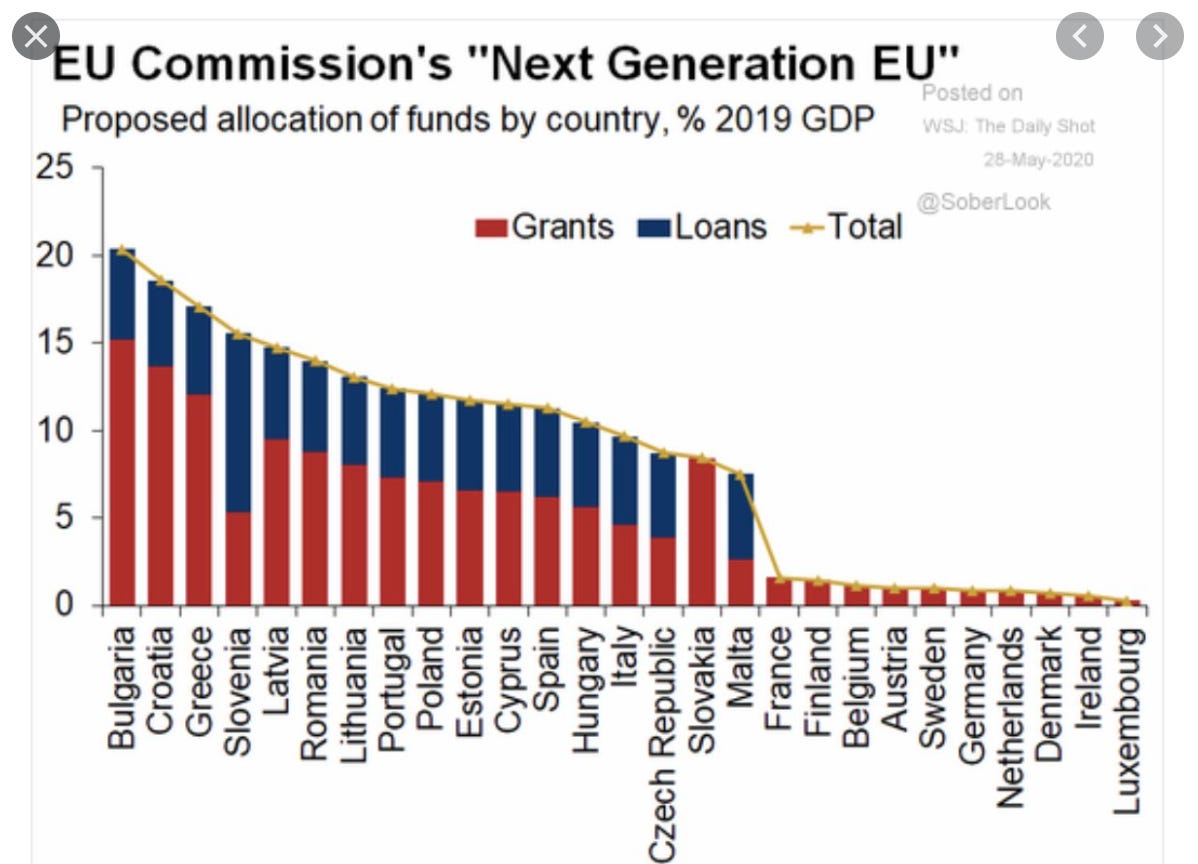

It is tempting to view this clash as an idiosyncratic US battle. All the more so, since Europe’s economic policy story took a more positive turn over the summer. Marco Buti of the Commission has referred to it, if not a “Hamiltonian” then at least a “Rooseveltian” moment for Europe. But, in fact, this week Europe’s package was roadblocked by a veto from Poland, Hungary and Slovenia all of whom object to the rule of law provisions that the European parliament and the German Presidency of the Council inserted into the program. Rather than the American and European stories being divergent, there was thus a nasty symmetry to their development, which I highlight in the FP piece. This headline by @herszenhorn of Politico says it all. Source: Politico You can only take this parallel so far. It is quite likely that the Europeans will cut a deal. The scale of the funds involved is so large that it is hard to imagine how the East European veto players can hold out. For the latest heroic effort to calculate who gets what see the work of Zolst Darvas. A rough breakdown looks like this:

10 percent of GDP is a lot of funding to forego! In any case, Europe currently faces an unappealing trade off. You make compromises on the rule of law with Hungary and Poland and thereby unleash a fiscal package that will benefit the European economy and relieve pressure on unelected technocrats of the ECB to drive policy response. Or, you stand fast in the face of Orban’s blackmail, which leaves you relying on Christine Lagarde and the ECB to keep the show on the road. And we know how fragile is the political coalition that supports ECB intervention.

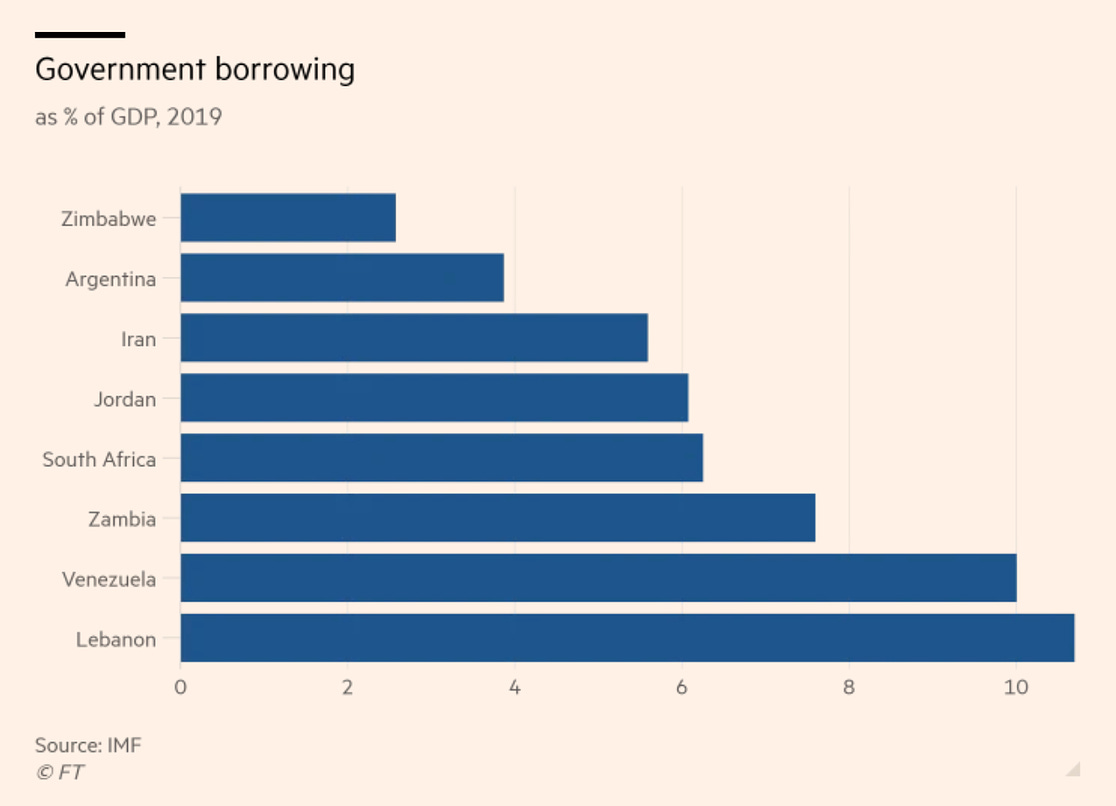

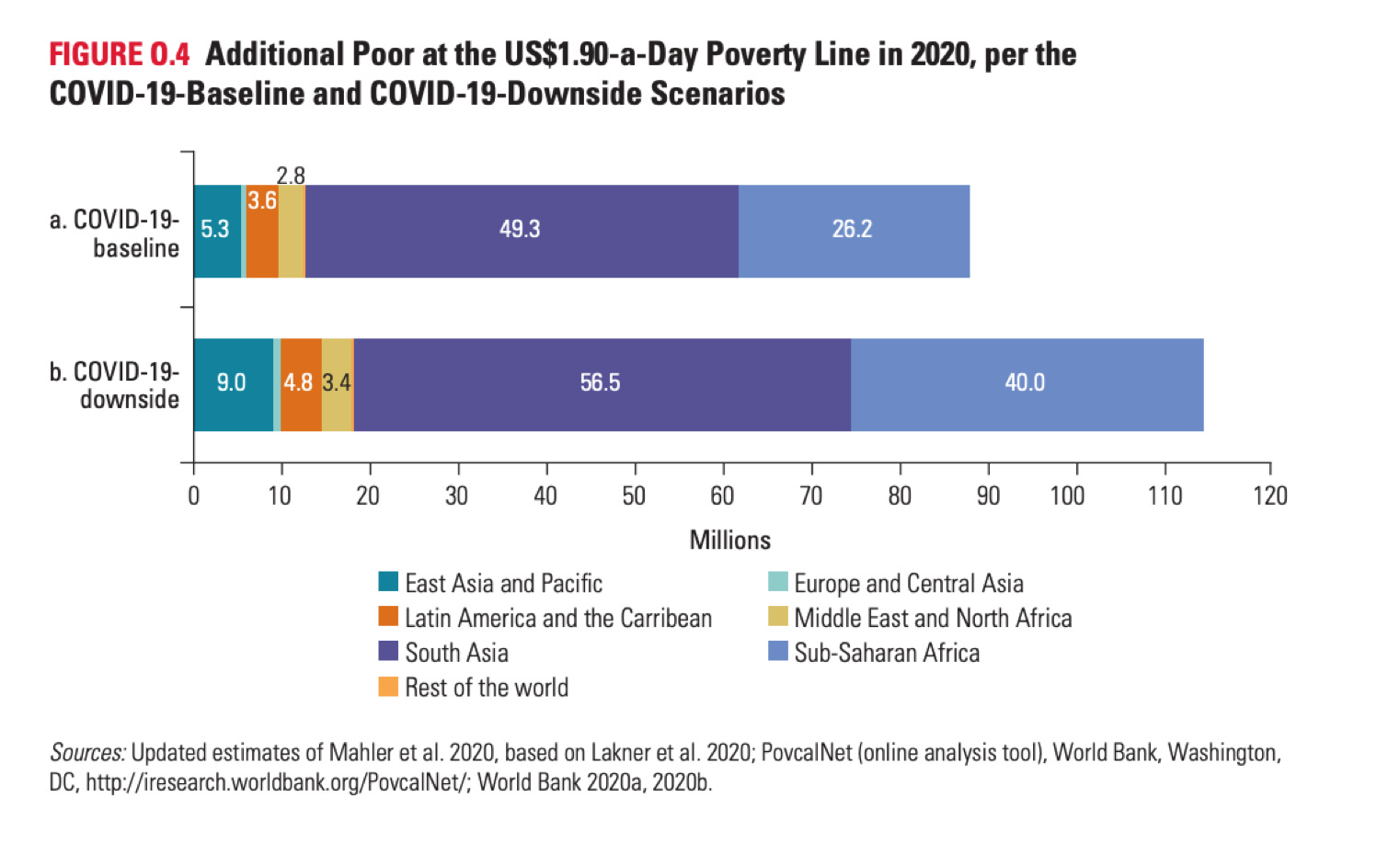

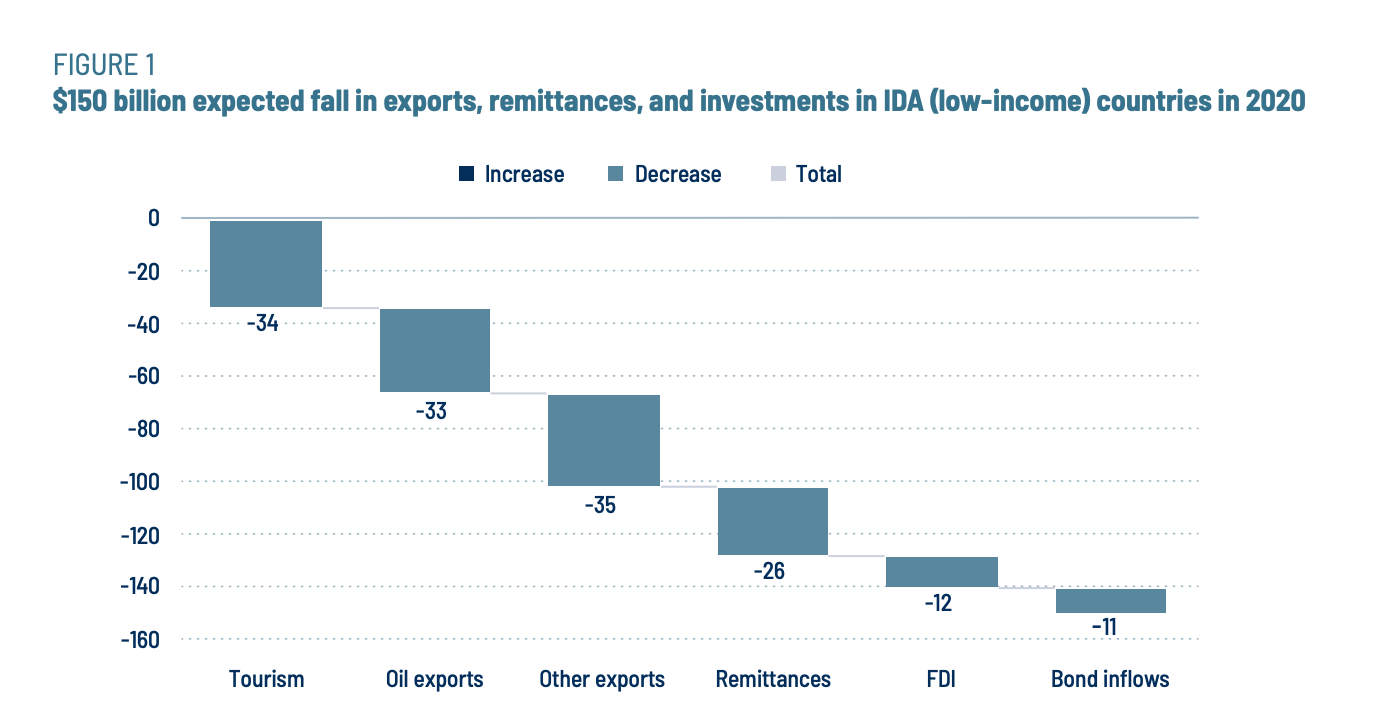

2. Debt relief Since the beginning of the corona crisis one of the biggest concerns has been the shock to the most vulnerable low-income economies. A clutch of large EM went into the 2020 crisis with budget deficits that were large already in 2019 making them vulnerable to funding pressure. Source: FT The World Bank has warned of a disastrous increase in poverty across the developing world as a result of the crisis. Source: World Bank In 2020 low income countries are expected to suffer a $150 billion fall in exports, remittances, and investments.

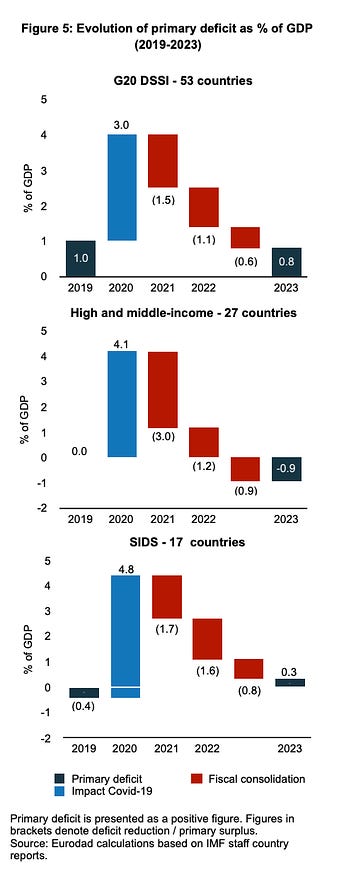

From G30 report on financing recovery helmed by @AGelpern @Brad_Setser Source: G30 Why, you might ask, should this be a matter of urgent attention for concerned citizens in rich countries and not just in the affected countries themselves? Because, as Paul Collier laid out in this excellent piece in the FT shocks are transfers. A fall in commodity prices that ruins exporters benefits commodity-importers. The collapse in tourism switches spending to other recipients in the advanced economies. By Sep 25 2020 the IMF had approved 95 separate support programs. The New IMF leadership talks a good game on development and equity. This “lunch with the FT” profile of Kristalina Georgieva, the Bulgarian boss of the IMF, is worth reading. She is clearly a remarkable person. But, what conditions were actually attached to the IMF’s programs? @danielmunevar of the @eurodad NGO open a can of worms in this fantastic report. Though the IMF nowadays stresses the need for “quality” public spending, Munevar’s analysis shows that they actually require severe fiscal contraction from 2021, which will have severely negative consequences both for the macroeconomy and the welfare systems.

The latest casualty to slide into open default is Zambia. As the FT puts it: “When Zambia sold the last of its three US dollar bonds in 2015, it capped a decade in which the copper-endowed African country went from needing debt relief reserved for the world’s poorest nations to tapping the global capital markets with ease. But just five years later, that bond is in default, with the rest of Zambia’s $3bn international bond borrowings, after President Edgar Lungu’s government skipped a $42.5m interest payment due last week in the middle of fraught negotiations on restructuring its debt.“ The collapse of Zambia’s currency the Kwacha has made its external debts of $12 bn punitively hard to service. @jsphctrl

Source: FT Copper is the resource which dictates Zambia’s insertion into the world economy. A reminder of what is at stake in that extractive industry is provided by this news item from the FT: “Anglo American is facing a class-action lawsuit filed on behalf of more than 100,000 Zambians over the toxic legacy of a huge mine in which it held a stake for decades.” Given the huge stress on some of the poorest economies in the world, the challenge is to devise a framework that involves all the major creditors and restores the conditions for growth. G20 is this weekend discussing a debt relief framework that is supposed to extend to all parties including private lenders. This makes sense. Otherwise relief provided by public creditors benefits private bondholders. But will debtor countries be willing to use it, if it forces renegotiation of private debt and risks exclusion from market? Pakistan has signaled that it will not ask for debt relief if it is forced to renegotiate with its private creditors too. Vera Songwe, UN Under Sec Gen Head of Uneca, says “last thing” developing countries need is enforced private-sector involvement in debt relief. She wants $100bn in concessional lending/grants (even if some flows to private lenders). This thus poses a serious dilemma for AE governments. And Geopolitics is never far away: As @Jonthn_Wheatley notes in this excellent article: “Trump-appointee David Malpass as Pres of @WorldBank has waged a war of words with China over debt relief despite fact that G20 docs show China responsible for $1.9bn out of $5.3bn of relief delivered by the DSSI, far more than any other creditor. So far, the debt crises of 2020 have been small. I am going to do a follow up newsletter on the six countries that have actually defaulted so far. Pop quiz: can you name all six? If you can, you have REALLY been following the news. But, the fear is that the destabilization could sweep across sub-Saharan Africa and beyond. “some observers think Brazil & South Africa, which are both in the G20 group of large nations, could face severe challenges in obtaining finance in coming 12-24 months.” @Jonthn_Wheatley Still experimenting with formats. So this is over and out for now whilst I check that the email format works etc. © 2020 Adam Tooze Unsubscribe |

Chartbook 238: Making & remaking the most important market in the world. Or why everyone should read Menand and Younger on Treasuries.

“The market for U.S. government debt (Treasuries) forms the bedrock of the global financial system. The ability of investors to sell Treasuries quickly, cheaply, and