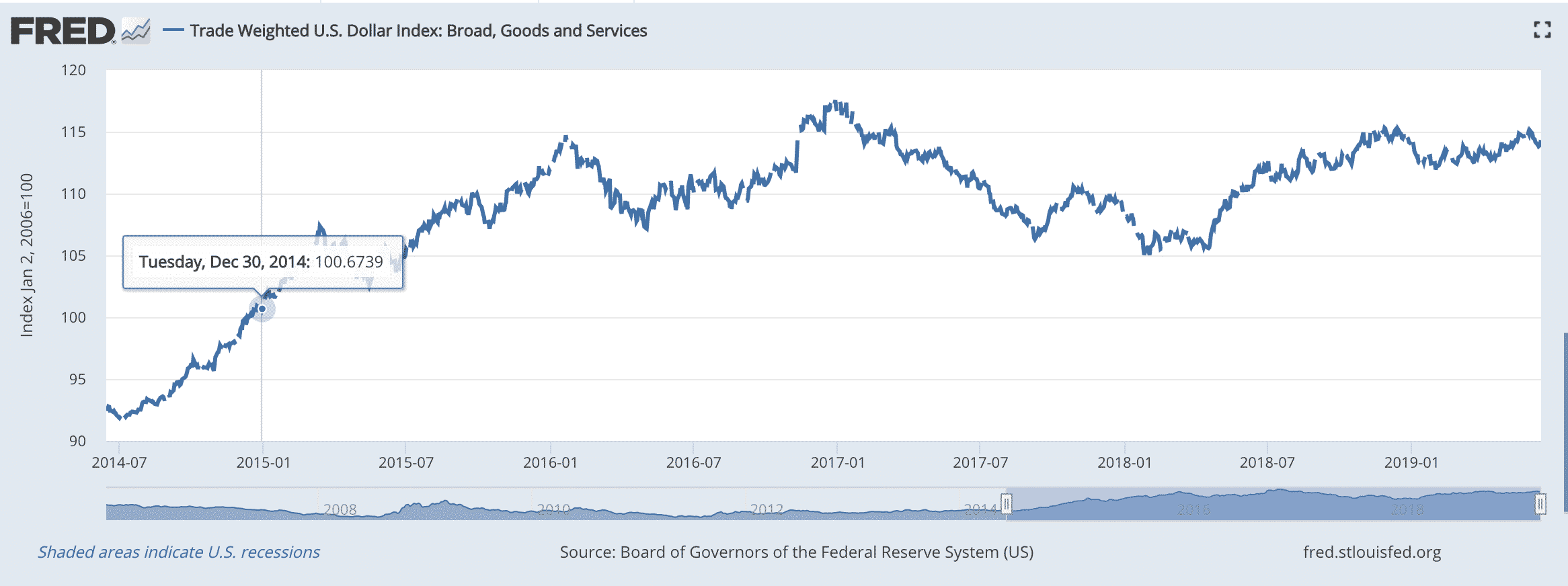

Between 2014 and 2016 the US dollar appreciated by almost 25 percent against a basket of world currencies. The shift was driven above all by the relatively strong US recovery and the unsynchronized Fed move to “normalize” interest rates, whilst the ECB was embarking belatedly on its massive QE exercise. The dollar’s strength has since then sustained at that higher level, though in recent months (as the Fed turned dovish and trade war talk escalated) there have been signs of weakness.

In the last couple of weeks smart people have been posting a rash of papers, talks and blogs about the implications of this dollar strength.

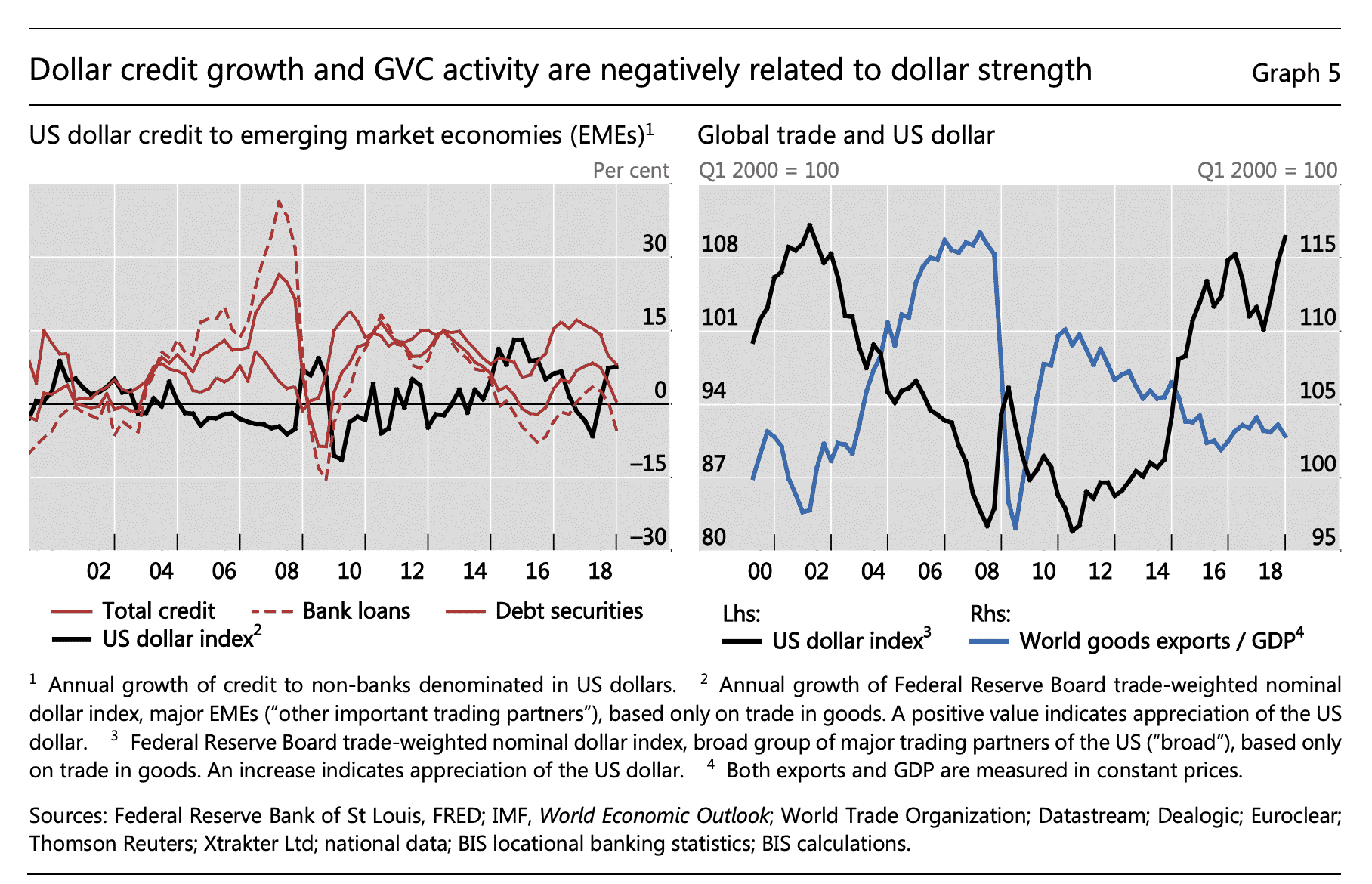

One would expect a shift of this scale to have a significant impact on global trade and the US trade balance in particular. This has political significant in light of Trump’s turn to protectionism and general hand-wringing about the death of the liberal order etc.

In retrospect it is one of the key chapters in the story of global recovery since 2008.

Hyun Song Shin in his fascinating work linking financial to trade flows makes the point that a strong dollar makes financing complex value chains more expensive and thus tends to inhibit trade, independently of any tariff.

Brad Setser at Follow the Money has outlined a set of guidelines for deciding whether a strong dollar is due to other people’s manipulation.

Brad has South Korea and Thailand in his crosshairs.

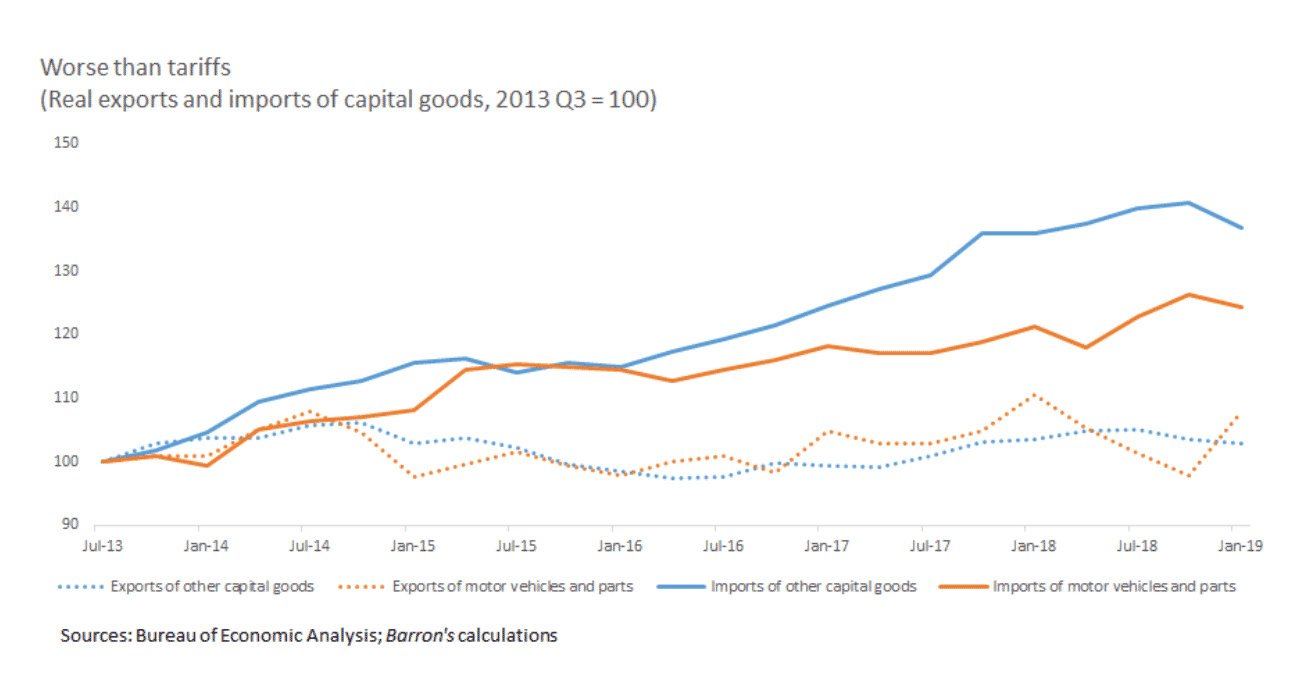

Matt Klein at Barrons has been insisting on the classic question of how the strong dollar affects the US trade balance. He equates the kind of appreciation of the dollar seen since 2014 to the impact of a tariff levied against US exports.

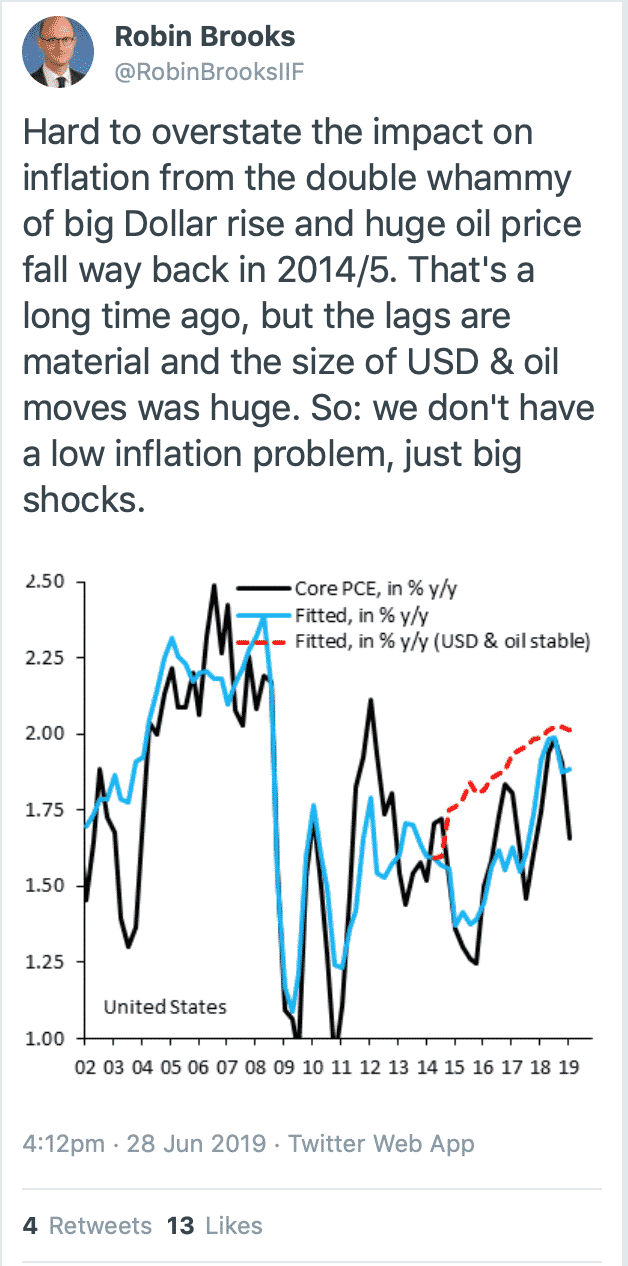

As Robin Brooks of the IIF pointed out this morning in a tweet, the strong dollar shock of 2014 (plus the oil price collapse) generated serious deflationary pressures. In his view this means that the problem of lowflation is not so much structural as due to (transient) shocks.

And Colby Smith with her ear to the ground at the FT has a piece this morning canvassing market opinion on the continuing strength of the US currency, even in the face of the Fed’s more dovish positioning.

The upshot? “If you dont buy dollars, what are you going to buy?”