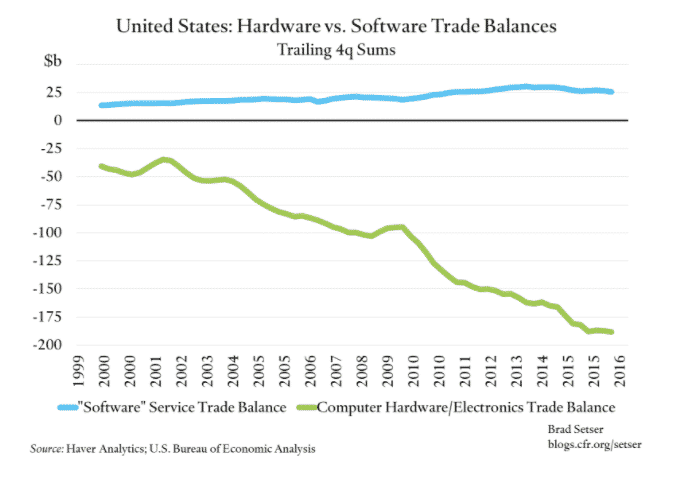

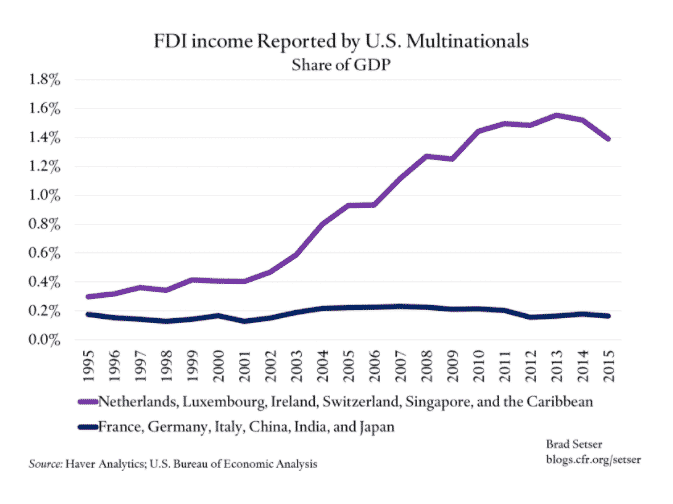

“Dark matter” is a big deal in the American financial balance with the rest of the world. In visible trade the situation is the dramatic one that drives Trumpite rhetoric. America has a big trade deficit. It imports a lot of hardware. Advocates of economic integration respond that America offsets this imbalance in visible trade with a variety of sources of income that are less tangible: software, human services, financial flows etc. But if you look at the trade statistics the US doesn’t export as much software as you might expect, at least according to the official statistics. At the same time America’s overseas investments earn a higher rate of return than foreign funds invested in the US. Part of this is due to the fact that foreigners use America as a piggy-bank investing disproportionately in the famous “safe assets” (the basis of the Bernanke savings glut theory and Gorton’s “safe asset” theory of the crisis). But even like for like, the US appears to earn more than foreign investors. US FDI earns about 6 % v. foreign investors earning 2 % or so in the US.

One hypothesis is that this is a reflection of “exorbitant privilege”. This is the view argued for by the brilliant team of Gourinchas and Rey who describe the US as the “world venture capitalist” borrowing funds cheaply and investing in risky high yielding ventures.

The invaluable Brad Setser now offers an alternative rather more political account.

http://blogs.cfr.org/setser/2016/12/15/why-doesnt-apple-export-more-services-wonky/

http://blogs.cfr.org/setser/2016/12/15/why-doesnt-apple-export-more-services-wonky/

http://blogs.cfr.org/setser/2017/02/02/dark-matter-soon-to-be-revealed/

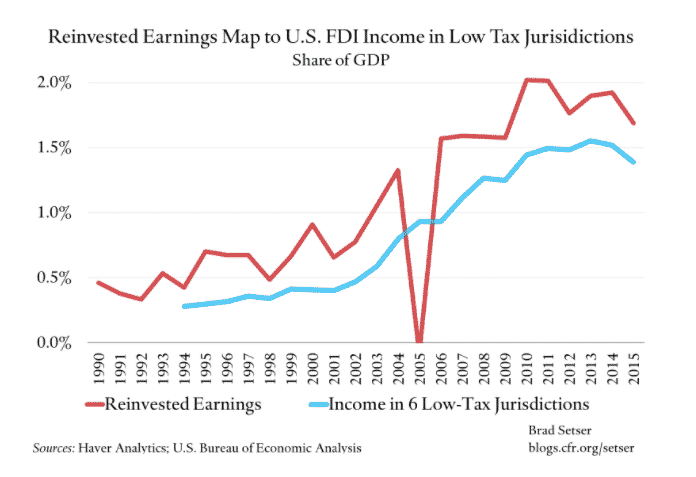

What he reveals is how the high “returns” booked to America’s foreign investments abroad and the modest level of American “software” exports are tied to the tax avoidance strategies of America’s multinationals. There has been since the early 2000s a truly remarkable surge in the profits being booked to tax haven jurisdictions like Ireland, Luxembourg, Switzerland, the Caribbean. That is where the “dark matter” seems to be concentrated. By contrast rates of return in high tax jurisdictions are pretty flat. As Apple books tens of billions in dollars in profit to its Irish subsidiary the result are artificially depressed software exports and inflated FDI returns, which will not be repatriated to the US until the tax regime is more to their liking.

There are fascinating wonkish aspects to this question which have to do with the relationship between macroeconomic accounts (such as the trade statistics and current account) and corporate strategies, mediated by the structures of the US state i.e. the tax regime.

Superficially there might seem tobe a connection here to the political question of “capital strikes”. Linking the kind of work that Setser’s is doing to a Kaleckian political theory of investment is an interesting and urgent challenge. A recent essay in Jacobin highlights the general theme.

Unfortunately, the Jacobin authors conflate offshoring of profits with the threat by banks to stop lending if financial regulation does not suit them, which is a separate question, above all of leverage. As was pointed out to me when I made a related argument a few months ago the circuits are complicated. US corporations can actually borrow in the US against the security of their offshore profits. So offshoring may deprive the US state of tax revenue without necessarily being associated with an investment strike, for which, in any case, the evidence is not all that strong. So what may be at stake here is that the US tax code and tax shelters like Ireland provide oligopolists with advantageous structures within which to house the cash hordes that they use to uphold their market power, buy out any potential entrants etc.

More on this in blogs to come.