The world economy right now is marked by two striking developments:

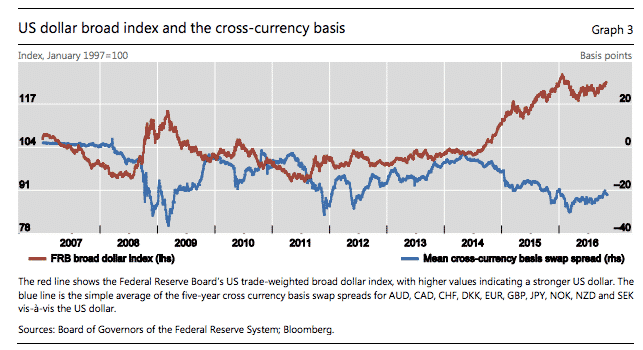

- signs of serious shortage of dollars in the dollar-based but non-US world e.g. Japanese international banking.

- slowdown in global trade growth

Could they be connected? Fascinating discussion of a recent paper by the BIS-guru Hyun Song Shin in the wonks playground that is FT alphaville from the queen of money-wonks Izabella Kaminska (follow her!).

Its a VERY twisted story. But the reduced form is that globalization makes huge demands for working-capital. Global working-capital is global dollars (Eurodollars). They have become harder to get hold of. It is commonplace and tempting to blame this dollar liquidity squeeze on new banking regulations, Basel III above all. But Shin and now Kaminska are arguing that it is more fundamentally due to a tightening of US credit conditions, of which more should be expected in future. So the struggle over US monetary policy that looms between Yellen and Trump may have serious implications for trade at a global level.

It’s really elaborate – it moves from bank balance sheets, to bank regulation, to central bank policy and currency markets and from there to real flows of production and exchange – but post-2008 this is really the kind of macro-finance story that we have to get to grips with.

https://ftalphaville.ft.com/2016/11/15/2179675/dollar-shortage-alert-plus-global-trade-alert/