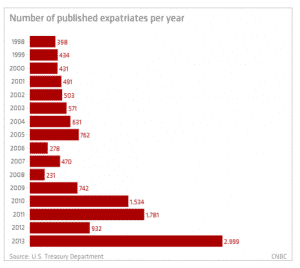

Americans opting out of citizenship…

Americans opting out of citizenship and the IRS reporting requirement. https://t.co/otyYiH0jrU

Americans opting out of citizenship and the IRS reporting requirement. https://t.co/otyYiH0jrU

one for @vanessahistory A sociologist trained to become a tax-avoidance expert @Atlantic https://t.co/fuWhHztARd

Its not like those simple-minded Communists ninnies ever managed to reshape demography before …. https://t.co/Mp0CRUudQO

GREAT tyler cowen note on "natural rate of interest". Even BIS noticeably cautious in reintroducing it. https://t.co/cWJYgSneQR

Sinn v. Varoufakis … should make for some entertaining watching over lunch! https://t.co/zo0yKdRmam

RIP Schabrowski party boss in E Berlin: will never forget watching him argue with huge crowd on Alexanderp. 4/11/89 https://t.co/zNjveJJcH5

Military strategy … European states? Do those words even go together? https://t.co/zTRcJtG26M

glory of twitter … by way of dirk baecker on the rise of Hitler and the logic of swarms I find Thesis Eleven ….nhttps://t.co/NMALTIME0b

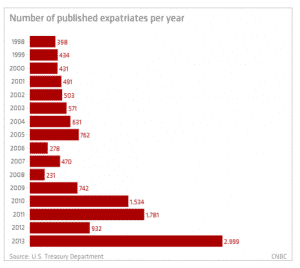

The banks that British business relied on for finance in 2007nhttps://t.co/SQtC2xjAIj https://t.co/U0mBWwWib6

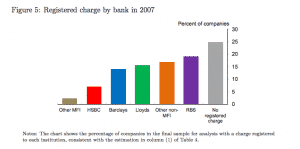

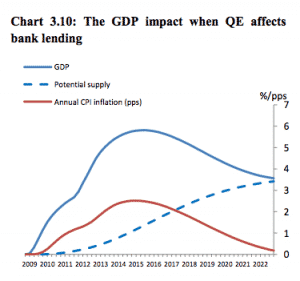

BofE view of QE trans, mech. Not through increased reserves & loans but thru asset prices.nhttps://t.co/766T8T6vt9 https://t.co/Bz3ta588xm

Estimating effects of QE in UK using a new, balance sheet driven macro modelnhttps://t.co/766T8T6vt9 https://t.co/6HdwCwy2mb

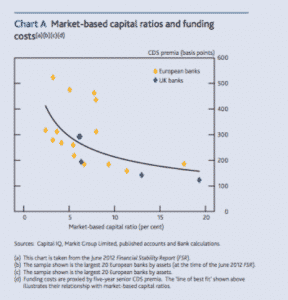

With Eurozone in crisis June '12 there was strong cor. between bank capitalization and borrowing costs https://t.co/Qir9GLG2ar

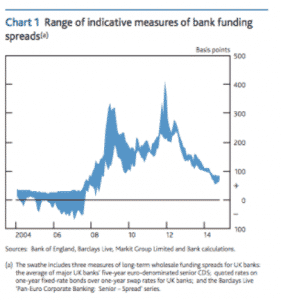

BofE graph on bank funding costs: note severe spike 2011-2012nhttps://t.co/GQ0PsAL9RU https://t.co/ZzGw6s7rDs

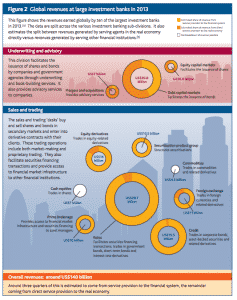

Where global investment banks made their money in 2013 https://t.co/pNpobYvzNQ

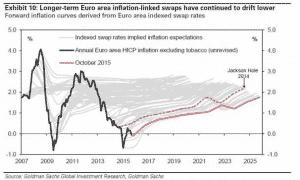

eurozone inflation expectations slide downwards nhttps://t.co/GQ0PsAtz0m https://t.co/vIpKgThanE

I swear …. they are surreal geniuses! https://t.co/fdoeLNJqbA

Another gem from the Forbes world of psycho-finance: "financial wellness"n https://t.co/Xc6BO8jHbv

Williams of SF Fed warns there may be fundamental shifts underlying low interest rates that Fed does not understand https://t.co/20bXa5rNj6

New book "The Ottoman Endgame" is a sweeping account of the last years of the empire https://t.co/djOorMlQJ6 https://t.co/PLiuB3IEOP

The buyer of last resort: The Genesee Land Bank that propped up collapsing housing market in Flint Michigan https://t.co/Cf9Nb2gQYU

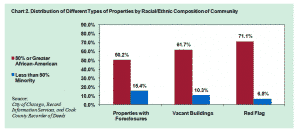

Racially selective impact of mortgage crisis in Chicago. Vacancy and dereliction concentrated in black areas. https://t.co/vrZxzvAcPx

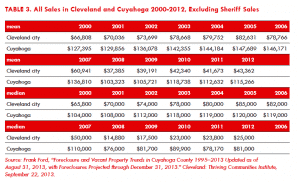

In the rustbelt the property bubble burst already in 2005-6. Mean price in Cleveland fell from 85k to 15k by 2008! https://t.co/qJE8OmhQCE

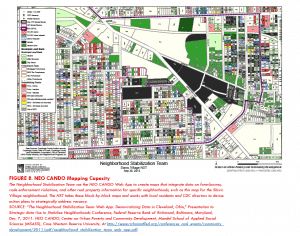

NEO CANDO GIS system used to target demolitions in Cleveland’s Slavic Village, where Deutsche Bank was slumlord https://t.co/PRKA8w8adQ

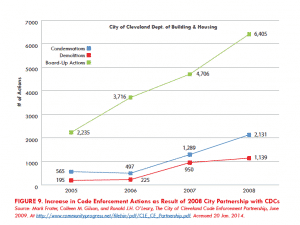

Boarding up a city: Cleveland https://t.co/aYI4rnvpwH

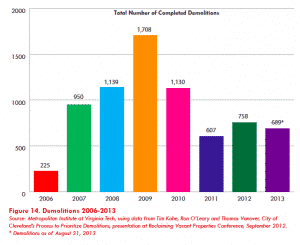

Razing urban decay in post-crisis America: Cleveland’s demolition program for vacant properties. https://t.co/Qnt6O8u79E

Taking the BIS approach one step further: UK econ as net of agent-agent financial connect. nhttps://t.co/FAguQ9LmpO https://t.co/AHKKtd6Wd2

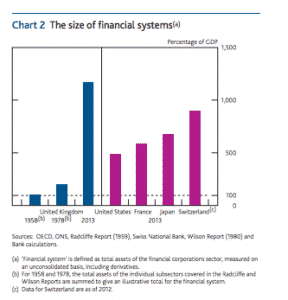

UK’s overgrown financial system in international comparison nhttps://t.co/FAguQa2Xhm https://t.co/4U67h7uftZ

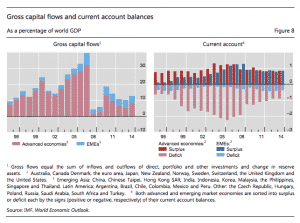

BIS transformative remapping of global econ: gross financing flows v. simple macro of savings & net current account https://t.co/LulzTqWfDL

Gross capital flows dwarf net current account balances https://t.co/PxYMkSgH8Q

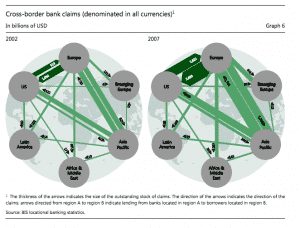

Why "Chimerica" was not the story: Financial flows US-Europe-Asia with Eur. as pivot rather than the Asia-US axis. https://t.co/x1hLh3qGgd

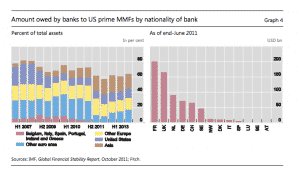

US MMF as the key barometer of crisis: pulling out of US banks first in 2008 and then European banks in 2011 https://t.co/pT7AuENRVw

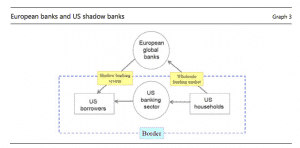

The essential nexus of the financial crisis: the interlock of European banks and US shadow banking https://t.co/bvE2ovWq4f

DB est that if Chinese growth is 2.3% lower then German growth would be 0.3 % lower with unpredictable knock on in lower confidence and

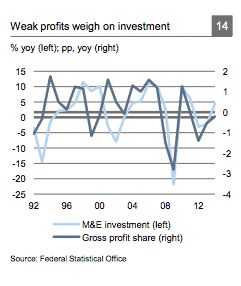

Consensus economy at its limits? Deutsche Bank asks: Will German wage growth squeeze profits & squeeze investment? https://t.co/hYJbxLcU9H

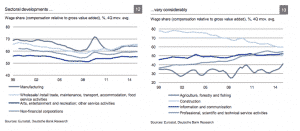

Compression of wage share in Germany since 2000 above all in construction and manufacturing https://t.co/dYeW0zavrQ

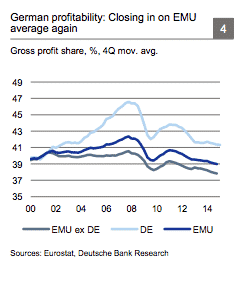

Striking parallel between the surging profit share in Germany and other Eurozone imbalances! https://t.co/Z1ZoRLpvWW