RT @elerianm: GM While most economists…

GM While most economists agree that we're in a downturn deeper than the "Great Recession" that followed the Global… https://t.co/hOxNPtmywl

GM While most economists agree that we're in a downturn deeper than the "Great Recession" that followed the Global… https://t.co/hOxNPtmywl

Thanks @ProfPaulPoast for another of your excellent threads. Can I also recommend as a research technique: Phon… https://t.co/dodlZ6ROzq

Another useful account is from Monnet's British counter-part, Arthur Salter (who Monnet also mentions in the above… https://t.co/cOhhhYoKy0

But Monnet mentions a clue: his superior Étienne Clémentel, the French Minister of Commerce https://t.co/xdvfDdGozZ

@ProfPaulPoast @rosellacappella Hi @ProfPaulPoast @rosellacappella great idea. Can I recommend contacting Prof… https://t.co/vaCSefriDK

Credit card debt on US bank balance sheets has been cut by 5 % Banks are making large loss provisions. FRED via… https://t.co/WX2odrqC1t

"dynamically reevaluate a customer’s creditworthiness.” Credit card firms are struggling to limit their losses if… https://t.co/KH9N4Uwv9O

@adam_tooze @martinwolf_ The marvelization of monetary policy.

Canada has the most negative rates of any major central bank, Mexico the highest rate. Japan is now in the middle o… https://t.co/cobOQyuV4k

Bad news for the luxury sector: one thing that is not rebounding is Chinese consumer appetite for luxuries.… https://t.co/H5ow0Q5CPC

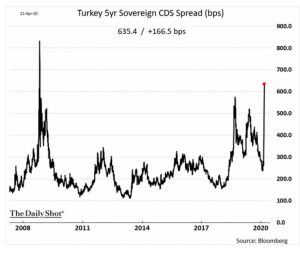

Default risk: Turkey’s CDS are now even more elevated than in 2018. Reserves low & Erdogan rules out IMF. @SoberLook https://t.co/LQNFeMW0Yp

Bad news for the luxury sector: one thing that is not rebounding is Chinese consumer appetite for luxuries.… https://t.co/c3jOWTPgLC

Default risk: Turkey’s CDS are now even more elevated than in 2018. Reserves low & Erdogan rules out IMF. @SoberLook https://t.co/GBT9JUlEoJ

It was only a matter of time: Christine Lagarde as Euro-woman, savior of the common currency. @martinwolf_… https://t.co/QiGigZpQHe

Great thread on the ECB’s response to the wave of downgrades. https://t.co/DrnzYc0PTV

Mexico’s central bank is caught in a dilemma. Its real interest rates are higher than its peers in Lat Am, but it d… https://t.co/bVI4DEW3rG

Watch this wonderful series about the history of the working class, and work! @adam_tooze https://t.co/BAazJICecK

The resurgence of smallpox and resultant pandemic in 2039 plunged the global Econ into a recession that lasted two… https://t.co/mONG1VkWHd

Pandemic crises in financial systems: a simulation-model to complement stress-testing frameworks. By Idier Julien,… https://t.co/rVUvKL1MxJ

China experienced a net capital outflow of c $19bn in March. But this is modest compared to the huge drain in 2015.… https://t.co/SJEFn5i3Z1

The huge surge in Fed purchases of Treasuries has had the effect of bringing volatility down and ensuring liquidity… https://t.co/w4JHjAC5ZI

About 20% of the CARES Act spending, $454 billion, will be used to backstop lending from the Federal Reserve. This… https://t.co/9CWgwpxbSc

The US deficit in 2020 will amount to $3.8trn $1trn predicted by @USCBO in Jan 2020 $2.2trn CARES act $0.6trn due… https://t.co/JBhyZgEDoi

The US debt to gdp ratio by 2023 is likely to exceed that reached during WWII CFRB aka @BudgetHawks… https://t.co/Qxlcl8eaMD

Coronavirus threatens $500bn hole in US state budgets – typically excellent piece by @bhgreeley on the huge financi… https://t.co/S1KhPVxXeo

Energy-sector corporate bond spreads are much too tight given what has transpired in the oil markets. The little re… https://t.co/iqaMSBcMP4

“Like eight elephants trying to fit through three small doors” In March the US commercial paper market began to ma… https://t.co/WLcsbfajjT

Stress Endures in Market Where Big Companies Turn for Cash REALLY good piece by @PaulJDavies @Annaisaac… https://t.co/70l506xSRI

What if Italian sovereign debt is downgraded to junk or comes even closer to the edge. Italian spreads have been ri… https://t.co/foVr3M4ylb

Turning Japanese – “slow debt monetization” – warehousing debt on the ECB balance sheet in the hope that voters and… https://t.co/YK6HVx8Oku

As California shuts down -> major refineries shutter -> oil now floats offshore in almost 36 huge tankers with enou… https://t.co/FhgEZx2yq6

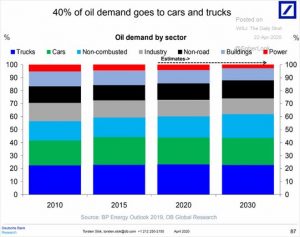

If you work your way back through the refinery process etc -=> 40% of all crude oil demand is attributable ultimate… https://t.co/KL8s7caHwY

The currency risk premium priced into Turkish Lira currency forwards is up (lhs, blue), as markets demand higher ra… https://t.co/HFG2nnzcsN

Having sabotaged the WTO’s appellate body, the US is now invoking the lack of rulings by that body to gain a free h… https://t.co/Th7f43Zdr8

Great @Brad_Setser thread on BoJ report on financial stability in Japan. Must read for swap-liners. https://t.co/l4rz4AiA4t

Breakdown of oil demand shows that 40% goes to cars & trucks alone @DeutscheBank @SoberLook https://t.co/7SQghsrLPG