RT @lucasguttenberg: Even within the…

Even within the MFF, the question for the Recovery Fund remains: How does it increase fiscal space for the hardest-… https://t.co/XEeJwtIETx

Even within the MFF, the question for the Recovery Fund remains: How does it increase fiscal space for the hardest-… https://t.co/XEeJwtIETx

This is another really good discussion with @HelenHet20 and @adam_tooze , this time on how Covid, finance and o… https://t.co/rCPuLunikj

Incredible to see that we have had 248,671 listens in the last 7 days. Thank you to *absolutely* everyone who has d… https://t.co/cCGb6HOEeH

Fed balance sheet out on time this week — Still no use of the new official repo facility But there were $409b in… https://t.co/AaDWEdnAZD

FRBNY data puts total swaps outstanding today at $432b. $215b from the BoJ (the biggest user). Koreans also using… https://t.co/ipiVDo9lES

"One woman’s reverie on the empty road, in the empty landscape, stands for the unanswered question of what socialis… https://t.co/XyQqCSGp8W

Uneven and combined development: Remittances which are a vital lifeline for families in many poorer countries are s… https://t.co/JEeAn8XO4i

One of the things that conversation with @HelenHet20 has taught me is NEVER to forget oil. Here is an effort, toget… https://t.co/Nd0Ed1udrd

What is the impact of oil counter-shocks? A long read for @ForeignPolicy in which @njtmulder and I borrow from this… https://t.co/ALUAhabCiO

Congress is effectively using the Fed as an off-balance sheet means to get out more economic relief. The Fed, in tu… https://t.co/pE8b9FGqJs

Downgrades top 300 in Q1 2020. https://t.co/ATnmbFausX

Potential access under IMF rapid facilities. Nigeria👀 https://t.co/8GMFN4QJib

On #EUCO, after 6 years in Brussels I have learned one thing: in @EU_Commission speak to "mobilise" or "trigger" €… https://t.co/waSQtBCVrf

How can Italian bond spreads be elevated (lhs), given the ECB is making big purchases via PEPP program? The forecas… https://t.co/CMLBKHYtmU

If this is the plan – €323bn in fresh money, including part of it in loans – it's DOA. https://t.co/3le671H2Nl

Euro down as EU leaders fail to reach a deal on crisis response. €540bn short-term fix won't cut it when US is thro… https://t.co/P2zBeGE1Hb

Pure gold. https://t.co/MXGkOrtwsY

The paramedics at the mortuary … CLO backed by leveraged loans are now facing their date of destiny with the rating… https://t.co/2g9SK4VUNX

Uneven and combined development – a piece with @njtmulder on the impact of the oil price shock around the world. In… https://t.co/yMoTPonTBS

Talking with David and @HelenHet20 is always a highlight. Now we have technology sorted out, thanks to @TPpodcast_… https://t.co/iK051j6IZr

Negative oil prices are unprecedented. But historically we have seen such extreme oil 'counter-shocks' before: in 1… https://t.co/b4IJmbJJI2

As @BCoeure notes … @JoergAsmussen has joined twitter! https://t.co/jU2kaFu7T0

By far the worst news in euro area PMIs: job losses. Markit: "In some cases, the employment decline reflected furlo… https://t.co/CTgDtHtUUt

@Brad_Setser Hi Brad can you make a blog out of your exchange with @RobinBrooksIIF too? Or the two of you?

Key point …. Early neoliberals saw planning minded empirical economists as social engineers. https://t.co/aLcVvHk5yJ

FT reports heavy selling of dollars by Turkey's state banks (likely acting for the CBRT) today Don't think there i… https://t.co/ft4TlEAit3

An unprecedented humanitarian crisis looms: defaults, mass unemployment, social turmoil & worse. Just after we went… https://t.co/BEk9ON3N9J

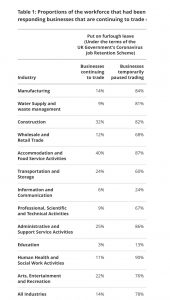

Absolutely extraordinary numbers. https://t.co/qfOz4jOTdf https://t.co/w7GeUnrq0a

Maybe it's because I periodically lecture on science and policy, but it is deeply shocking that ministers didn't gr… https://t.co/T41PAw1vcw

4.4 million Americans sought jobless benefits last week, bringing 5 week total to more than 26 million, as economic… https://t.co/b9aqj7mLlE

With foreigners out, ultimately locals will have to do the heavy lifting, and therein CBRT will have to supply the… https://t.co/oDZnb5aCcE

Hertz the rental car company now faces an implied two-year borrowing cost of 55%.

Huge surge in liquidity from global central banks driven above all by massive effort of the Fed. https://t.co/CdCXG2BMyq

Hertz has gone from appearing solvent to the brink of bankruptcy in less than two months. Its implied two-year borr… https://t.co/CObzfh096f

Bigger mortgage loans are getting hard to get hold of in the US. Via @SoberLook https://t.co/dPF79ZtW4Q