IMF devotes the entire Fiscal Monitor to fiscal policy and climate change. Estimates suggest that a $75/ton carbon… https://t.co/XjGixMJM9c

Archive

Testing energy investment scenarios across IAMs starkly reveals the hidden logic of the 2015 Paris climate agreemen… https://t.co/TRQm1jM1Ou

The scale of investment necessary for clearn energy transition should NOT be a major obstacle. Concentrating it in… https://t.co/ttLsxgP47K

To achieve energy transition, what is needed is not a huge surge in investment/GDP but a rapid shift from brown to… https://t.co/0KOFzZ9Y5J

Since 1990 the balance of public spending on energy R&D has shifted dramatically away from nuclear, fossil fuel tow… https://t.co/8HPPPAEGs9

@adam_tooze there are some numbers which put it at cost neutral by 2045. See Goodall 'The Switch'.

I just saw that the @BostonReview has collected a number of responses to the February essay by @rodrikdani, Suresh… https://t.co/iil8pvxtG7

We are at risk of overhyping challenge of a global green new deal. If you believe IMF, hitting a 2°C track only req… https://t.co/nxlJESdKrc

Christmas reading? I didnt see this coming. 1700 pages from Juergen Habermas on the question of how far post-metaph… https://t.co/sga1pyZATc

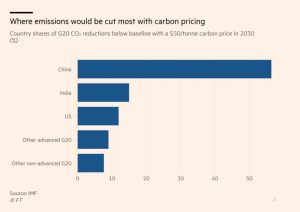

A $50 per ton CO2 tax would result in a huge reduction in emissions in China. https://t.co/Hni1vKGcql https://t.co/Pdefwpp9mN

@dsquareddigest @FT @BMF_Bund Agreed. But the use of the language of “safe portfolio” does seem to me to be telling… https://t.co/7pCKNmpAmT

How is Europe supposed to respond to private diplomacy of leading figures in Merkel’s incoherent GroKo? After AKK o… https://t.co/kz33X9p9Qi

"In this way, banks in all countries would build up a “safe portfolio” of sovereign bonds over time.” Buried in th… https://t.co/0rVu8NAjhO

IMF estimates total GLOBAL Public Energy R&D spend at $19bn. … $19bn. Thats peanuts! If there is a magic bullet fo… https://t.co/RW4fu5aPY7

@PeterFr89977258 @EuroBriefing Yes it is. And that makes it look better. Which is why I find fantasies about ending… https://t.co/V3uL9N0KYQ

In his @FT piece @BMF_Bund Scholz bluntly announced "sovereign bonds are not risk free”. If you read full non-pape… https://t.co/RlFtLwahDg

The payoff from a $50 per ton carbon tax would be greatest in China, India and Russia. @martinwolf_ discussing IMF… https://t.co/RwwzXiVyH6

A "better than Paris” $50/ton carbon tax will halve global employment in coalmining. It will also save 100,000s liv… https://t.co/n8n8d3O2xR

According to @TheEconomist one-in-five US billionaires made their loot from rent-seeking activities — including big… https://t.co/azYI8cfvP2

Ich habe keinen Nazi Vergleich gezogen @andreasbotsch @GustavAHorn @hsc55 In der webversion die ich online lesen k… https://t.co/1aaLE6DDTl

@Bartz70Tim @hsc55 @DerSPIEGEL Hi Tim Ive read it closely and what is striking is the jarring discrepancy btw illus… https://t.co/FURC7Twkqs

Can I just clarify that I quoted the UBS piece on the triumphs of billionaire-run companies as an example of transp… https://t.co/S2PRd75Yj0

@michaelxpettis Yup. I quoted it not as an outstanding piece of research but as an instance of self-serving logic o… https://t.co/7tVeYlok6q

Mundane facts of average American household’s expenditure, taxes and savings. Still the largest source of demand in… https://t.co/aTTjtPoEXI

China is so sui generis it is useful once in a while to view world economy without it. Data from @SergiLanauIIF sho… https://t.co/jqyMkFejkl

Fund managers the world over are basically fairly pragmatic/Keynesian when it comes to fiscal policy. Currently the… https://t.co/QauUZfQ0DQ

Economic growth outside the US is negatively correlated with strength of dollar. A @BIS_org theme. @CapEconomics vi… https://t.co/kwm5IsyZbl

"Foreign sources of short-term loans are almost as large a creditor to US non-financial companies as domestic lende… https://t.co/K716WUdb2n

Along with automotive, tech is one of the sectors worst hit by global trade slowdown. And that is bad for East Asia… https://t.co/ZT1Pj4y3IG

The bottom end of the US junk market for corporate debt is experiencing another wave of pressure with coal and shal… https://t.co/CdYok72XVr

"Before it is too late, we should embark in earnest on the most fundamental existential (& also truly revolutionary… https://t.co/9OfaofkdeW

Whilst welcoming movement in Berlin, @FT points out that Scholz banking union initiative would strip sovereign debt… https://t.co/ca8tnhwCAz

@LevyAntoine It is all about the visual rhetoric. As you say it is a matter of fact business that in no way merit… https://t.co/DHVMgrABcb

Categories

- After the Crisis

- America's Political Economy

- Archive

- Atlantic Council

- Audio

- auf Deutsch

- Barron's

- Bloomberg

- Brexit

- Britain

- Call to Europe

- Carbon note

- Central Banking

- Centre for European Reform

- Centre Marc Bloch

- Chartbook

- Chartbook Archive

- China

- ChinaTalk

- Climate Crisis

- Climate Political Economy

- Columbia European Institute

- Corona – das Virus und die Wirtschaft

- COVID

- Crashed

- Crashed to Corona

- Critical theory

- Daily Notes

- DAVOS

- Debt Politics

- Democracy

- e-flux

- El País

- Europe

- Europe's Political Economy

- Ezra Klein

- Featured

- Financial Times

- Foreign Policy

- Forum for a New Economy

- Framing Crashed

- German Question(s)

- Germany

- Global Political Economy

- Global Political Economy

- Green Central Banking

- GZERO World

- History

- inforadio

- Intelligencer

- Internationale Politik Quarterly

- Jacobin

- JFI

- London Review of Books

- Modern History

- NBC Global Hangout

- New Left Review

- New Materialisms

- New Statesman

- New York Review of Books

- New York Times

- NOEMA

- Notes on Social Theory

- Notes on the Global Condition

- Novara Media

- Ones and Tooze

- Pin

- Politics Theory Other

- Prospect

- Reading

- RealVision

- RECET

- Response to Anderson:

- Room for Discussion

- Russo-Ukrainian War

- Scrapbook

- Shutdown

- Social Europe

- SWOP

- Talking Politics

- The Active Share

- The Drift

- The Guardian

- The Hill

- The New Yorker

- The Paper

- Top Links

- Travel

- UK

- Unhedged Exchange

- United States

- USA

- Video

- Wall Street Journal

- War in Germany

- Washington Post

- World Review

- Zeit