Add to that @70sBachchan @policytensor the loop internal to US/UK financial markets in which scramble by fund manag… https://t.co/DhbujSiZ55

Archive

In the struggle over the corona financial safety net battles like the one outlined here over America’s ailing shale… https://t.co/LQ5Hn1Hb8z

The shutdown is a spectacular experiment in behavioral change. Does it point way forward for decarbonization. What… https://t.co/4k2mEeTgEb

This is an essential point that turns intertwining of structure and agency into a methodological principle: You sho… https://t.co/mIHyNoVtmp

Viruses will always seem scarier than mass extinction & warming because we're social animals whose politics of prox… https://t.co/X31Pkns1bA

At the interface between the climate crisis and corona we are going to want to listen to @70sBachchan https://t.co/5jiehctjK7

A rare macro tweet to highlight some excellent work by @Brad_Setser . Unlike 2008 (financial crisis that morphed in… https://t.co/427Yiec8h6

Wow … sterling is beginning to look like an EM currency! https://t.co/wOQBUx334f

Kudos to @JohnJCrace for speaking honestly … for speaking his mind. https://t.co/le4gPglUWF

Above all the failure of the US to adopt adequate containment is going to make it into a truly national crisis in a… https://t.co/MlqSxyjuev

In handling the pandemic, the rivalry between the US and China has been destructive enough. Let us hope that it doe… https://t.co/Fxte62BSlt

Read this post by @Brad_Setser to the end! His anatomy of possible dollar funding problems is essential. Global ban… https://t.co/L5bDhJADlw

The EM sudden stop is one of the least-reported dimensions of the current moment of tension. Going to affect hundre… https://t.co/ErdGZDNeOs

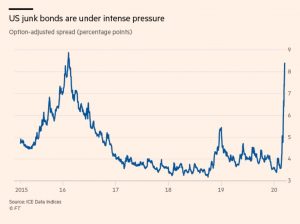

US junk bond issuer are under intense pressure as spreads spike. @JARennison https://t.co/xY1JXDt8GZ https://t.co/KFSWUQdZzs

Visited a Costco this morning, where most shelves were empty on the weekend… Trust the food supply chain. https://t.co/y9tR6x0O3d

Swap lines at the ready? Haven’t we been here before. But this time IS different … funny things DO turn out that wa… https://t.co/6KL7i4ct2v

Feelings of finance twitter: This might be like 2008 but it depends a bit on my cough and that odd queasy feeling a… https://t.co/a7zyD80eyz

Counting the days on the Chinese recovery. Great news that there is more from @BaldwinRE et al in the works. https://t.co/NA9SIihcq6

Exhibition stand of the British Iron & Steel Industry 🚧 https://t.co/hakv0k42o7

Is the Coronavirus Crash Worse Than the 2008 Financial Crisis? A first effort to sift through the extraordinary eve… https://t.co/Y5pFwRHuaj

In 2008 the Fed resorted to massive swaps because European banks ran out of good collateral in NY. In 2020 if China… https://t.co/Uro9GGNm6W

On the need for the Fed to extend the swap lines to EM @Birdyword is spot on. https://t.co/po0iLJuxwb https://t.co/6IHGuLPmNh

Interesting nuggets here on publicly-funded corona virus research and the struggle to contain profiteering by Pharm… https://t.co/84I75BVG4v

How big is this recession going to be? @DeutscheBank thinks it will be the worst since 1945. https://t.co/LNOV8t6ffJ

Swap lines seem to be working for the core group! What about the EM? https://t.co/ThIVKJhd1j

“There has been a lot of enthusiasm regarding PBoC interventions here in Europe, especially given that the ECB's ma… https://t.co/5SXbApUllO

Mexico caught between corona & the oil shock with Pemex and its $100bn in debt hanging over it, is really in the cr… https://t.co/zd9aJmqU5p

Anyone assuming that "things are going to be different in Germany” should stick this thread through google translat… https://t.co/d4TmOeRcB8

Good news from China. A rebound is underway. But NB: they managed to contain virus in one province, were able to t… https://t.co/bXypaKFrN2

It turns out that US gov does have emergency response capacities! There are ways of drawing on military. But they h… https://t.co/27gnmj6pho

When folks said that “neoliberalism” was an order based on “free markets” AND “strong state”. I think we assumed th… https://t.co/SOqO2dRTkE

Yellen and Bernanke applauding Fed’s decision to go full 2008 PLUS a call for Congress to permit Fed to buy investm… https://t.co/lJJKrNzk0l

Early in the corona panic, investors were continued to move into safe EM bonds. In late February that reversed sign… https://t.co/SWnFZmBPFJ

“We are not here to close spreads.” @GeneralTheorist Estimates that those 7 words probably cost Italy EUR14 billion… https://t.co/XiT7DhLcpE

One good thing about this crisis: 2008 gave us the language of systemically important financial institutions 2020 g… https://t.co/WkFV2z9WDk

Categories

- After the Crisis

- America's Political Economy

- Archive

- Atlantic Council

- Audio

- auf Deutsch

- Barron's

- Bloomberg

- Brexit

- Britain

- Call to Europe

- Carbon note

- Central Banking

- Centre for European Reform

- Centre Marc Bloch

- Chartbook

- Chartbook Archive

- China

- ChinaTalk

- Climate Crisis

- Climate Political Economy

- Columbia European Institute

- Corona – das Virus und die Wirtschaft

- COVID

- Crashed

- Crashed to Corona

- Critical theory

- Daily Notes

- DAVOS

- Debt Politics

- Democracy

- e-flux

- El País

- Europe

- Europe's Political Economy

- Ezra Klein

- Featured

- Financial Times

- Foreign Policy

- Forum for a New Economy

- Framing Crashed

- German Question(s)

- Germany

- Global Political Economy

- Global Political Economy

- Green Central Banking

- GZERO World

- History

- inforadio

- Intelligencer

- Internationale Politik Quarterly

- Jacobin

- JFI

- London Review of Books

- Modern History

- NBC Global Hangout

- New Left Review

- New Materialisms

- New Statesman

- New York Review of Books

- New York Times

- NOEMA

- Notes on Social Theory

- Notes on the Global Condition

- Novara Media

- Ones and Tooze

- Pin

- Politics Theory Other

- Prospect

- Reading

- RealVision

- RECET

- Response to Anderson:

- Room for Discussion

- Russo-Ukrainian War

- Scrapbook

- Shutdown

- Social Europe

- SWOP

- Talking Politics

- The Active Share

- The Drift

- The Guardian

- The Hill

- The New Yorker

- The Paper

- Top Links

- Travel

- UK

- Unhedged Exchange

- United States

- USA

- Video

- Wall Street Journal

- War in Germany

- Washington Post

- World Review

- Zeit