Meet Howard Marks He doesn’t like the Fed’s interventions in junk bond markets. His business is buying deeply disc… https://t.co/7YHWSwL1iL

Archive

This by @zeynep @TheAtlantic is excellent both on the WHOs failings in its kowtowing to China and on the damage bei… https://t.co/zE6pr9gG95

COVID-19 has shown conclusively how rapidly and extensively the structures of economic life can be changed, and how… https://t.co/OZrtNMtVSn

Since everything seems to be on the table right now and we are getting used to thinking in trillions, it is perhaps… https://t.co/oIaawcE5xX

How the 9th April Fed/Treasury deal was done: work on began again at 5 a.m. Thursday, with Powell and Mnuchin resum… https://t.co/OYjBZU3k4H

At IMF/World Bank guardians of Global Economy Come Up Short in Fight Against Virus But the question is why? In thi… https://t.co/1QO9Y91gpo

“I had modest expectations, which they significantly disappointed,” @LHSummers on the IMF/World Bank spring meeting… https://t.co/e2RNvTvR79

Share of central bank holdings of government debt in Japan, US and UK, 2004-2017 (Q1) This paper by @jryancollins… https://t.co/aJKHvnKrPX

If you worried about lopsided dominance of giant/online retailers/food chains before COVID-19, you should really wo… https://t.co/Z9w7nrb4LX

CMBX 6 BB v. The mall: This is fascinating on the bets being placed on the demise v. survival of America’s shoppin… https://t.co/NHHh9geRi2

US retail sales fell more sharply in March than at any time in 2008 recession. @SoberLook https://t.co/C4kCou2IHN

For real? EU rebadges cohesion funds as corona crisis response but then allocates the funds according to old key ->… https://t.co/3pj0orp4Qr

COVID-19 has hit car sales in US by 27% but clothing by 50% go figure … @SoberLook https://t.co/CSvMWcuhwQ

The stakes are high in IMF/WB reaction to COVID-19 crisis. @AdamPosen. At stake is question of liberal leadership… https://t.co/7WEuSPd87W

And so it begins: “Going forward all countries will have to focus on reducing the very high debt ratios and ensurin… https://t.co/yZR6f5WPU0

Cement shipments in Eastern China are back to normal. Suggesting that real estate-construction is leading recovery… https://t.co/ASTQgkFjeD

With support for Greens collapsing Merkel’s CDU alone is now stronger than Red-Red-Green coalition. AfD on skids. https://t.co/wu8LmHGZ7a

Will the early recovery in China (driving imports) v. Recession in West (crushing exports) -> Chinese trade deficit… https://t.co/BlDV29y9xN

How South Korea flattened the curve. From the official report: Flattening the curve on COVID-191: How Korea respon… https://t.co/q0ISjR8pbA

Do you expect world to be back to normal by June? 85% Brazilians 83% Indians 49% Italians! 19% Japanese… https://t.co/qK35vTmBF5

“The depth of the recession, just in terms of jobs lost and fallen output, will not compare to anything we’ve seen… https://t.co/hBjsnGGhmk

With Ankara low on reserves, no swap line and refusing to consider IMF option, Turkish lira is sliding towards lows… https://t.co/j6N3gnmnWy

"What’s the same about 9/11 and the pandemic is that it altered your sense of reality instantly.” Jim Hackett, CEO… https://t.co/5Jmz1Gab2B

Early 2020 saw a surge in foreign holdings of US Treasurys that coincided with a slump in yields to record lows.… https://t.co/4IO1XDuGoz

War economy is not the right analogy! Postwar DEMOBILIZATION IS. US factory output in March falls by most since af… https://t.co/ZH5RbMdnIy

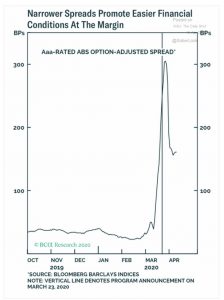

The announcement of TALF 2.0 was enough to bring ABS spreads down. @bcaresearch via @SoberLook https://t.co/A2hNtSdOPF

Our high-frequency tracker of non-resident portfolio flows to EM shows that the week ending today is the first one… https://t.co/IzqZUDMvZU

Following Fed intervention Junk bond ETFs now trade at premium to their net asset values! @PavilionGlobal via… https://t.co/m1FN7kYezV

At the current low oil prices you would expect HY energy spreads to be far larger. Market priced for V-shaped recov… https://t.co/6AYg8Oj4d2

US banks are making huge provisions for losses to come. @business via @SoberLook https://t.co/ti8AWbeKIJ

Master avant-garde guitarist/composer, Palilalia Records imprinteur and Harry Pussy co-founder @billorcutt curates… https://t.co/Bh96k75xJL

Investors need to understand why Fed Chair Powell is taking these stunning gambles. Fed fears that looming economic… https://t.co/hYgwM9Nv6e

"Powell is fast becoming the least cautious — or dull — Fed chair in history.” @gilliantett https://t.co/yP7tKO2rRx https://t.co/dbfd3MWNMK

Lorie K. Logan is the force behind the Federal Reserve’s EPIC asset purchase programs. Veteran of 2008, her bio is… https://t.co/gQ5sgmNvMW

Fed purchases of assets in week starting March 23 2020 were simply staggering. Matching entire BofE and ECB program… https://t.co/iXqGfOLLgL

Categories

- After the Crisis

- America's Political Economy

- Archive

- Atlantic Council

- Audio

- auf Deutsch

- Barron's

- Bloomberg

- Brexit

- Britain

- Call to Europe

- Carbon note

- Central Banking

- Centre for European Reform

- Centre Marc Bloch

- Chartbook

- Chartbook Archive

- China

- ChinaTalk

- Climate Crisis

- Climate Political Economy

- Columbia European Institute

- Corona – das Virus und die Wirtschaft

- COVID

- Crashed

- Crashed to Corona

- Critical theory

- Daily Notes

- DAVOS

- Debt Politics

- Democracy

- e-flux

- El País

- Europe

- Europe's Political Economy

- Ezra Klein

- Featured

- Financial Times

- Foreign Policy

- Forum for a New Economy

- Framing Crashed

- German Question(s)

- Germany

- Global Political Economy

- Global Political Economy

- Green Central Banking

- GZERO World

- History

- inforadio

- Intelligencer

- Internationale Politik Quarterly

- Jacobin

- JFI

- London Review of Books

- Modern History

- NBC Global Hangout

- New Left Review

- New Materialisms

- New Statesman

- New York Review of Books

- New York Times

- NOEMA

- Notes on Social Theory

- Notes on the Global Condition

- Novara Media

- Ones and Tooze

- Pin

- Politics Theory Other

- Prospect

- Reading

- RealVision

- RECET

- Response to Anderson:

- Room for Discussion

- Russo-Ukrainian War

- Scrapbook

- Shutdown

- Social Europe

- SWOP

- Talking Politics

- The Active Share

- The Drift

- The Guardian

- The Hill

- The New Yorker

- The Paper

- Top Links

- Travel

- UK

- Unhedged Exchange

- United States

- USA

- Video

- Wall Street Journal

- War in Germany

- Washington Post

- World Review

- Zeit