As @BCoeure notes … @JoergAsmussen has joined twitter! https://t.co/jU2kaFu7T0

Archive

By far the worst news in euro area PMIs: job losses. Markit: "In some cases, the employment decline reflected furlo… https://t.co/CTgDtHtUUt

@Brad_Setser Hi Brad can you make a blog out of your exchange with @RobinBrooksIIF too? Or the two of you?

Key point …. Early neoliberals saw planning minded empirical economists as social engineers. https://t.co/aLcVvHk5yJ

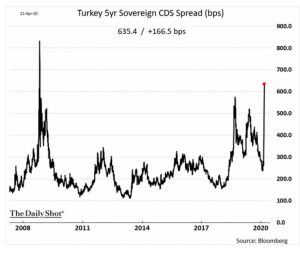

FT reports heavy selling of dollars by Turkey's state banks (likely acting for the CBRT) today Don't think there i… https://t.co/ft4TlEAit3

An unprecedented humanitarian crisis looms: defaults, mass unemployment, social turmoil & worse. Just after we went… https://t.co/BEk9ON3N9J

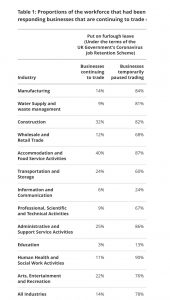

Absolutely extraordinary numbers. https://t.co/qfOz4jOTdf https://t.co/w7GeUnrq0a

Maybe it's because I periodically lecture on science and policy, but it is deeply shocking that ministers didn't gr… https://t.co/T41PAw1vcw

4.4 million Americans sought jobless benefits last week, bringing 5 week total to more than 26 million, as economic… https://t.co/b9aqj7mLlE

With foreigners out, ultimately locals will have to do the heavy lifting, and therein CBRT will have to supply the… https://t.co/oDZnb5aCcE

Hertz the rental car company now faces an implied two-year borrowing cost of 55%.

Huge surge in liquidity from global central banks driven above all by massive effort of the Fed. https://t.co/CdCXG2BMyq

Hertz has gone from appearing solvent to the brink of bankruptcy in less than two months. Its implied two-year borr… https://t.co/CObzfh096f

Bigger mortgage loans are getting hard to get hold of in the US. Via @SoberLook https://t.co/dPF79ZtW4Q

GM While most economists agree that we're in a downturn deeper than the "Great Recession" that followed the Global… https://t.co/hOxNPtmywl

Thanks @ProfPaulPoast for another of your excellent threads. Can I also recommend as a research technique: Phon… https://t.co/dodlZ6ROzq

Another useful account is from Monnet's British counter-part, Arthur Salter (who Monnet also mentions in the above… https://t.co/cOhhhYoKy0

But Monnet mentions a clue: his superior Étienne Clémentel, the French Minister of Commerce https://t.co/xdvfDdGozZ

@ProfPaulPoast @rosellacappella Hi @ProfPaulPoast @rosellacappella great idea. Can I recommend contacting Prof… https://t.co/vaCSefriDK

Credit card debt on US bank balance sheets has been cut by 5 % Banks are making large loss provisions. FRED via… https://t.co/WX2odrqC1t

"dynamically reevaluate a customer’s creditworthiness.” Credit card firms are struggling to limit their losses if… https://t.co/KH9N4Uwv9O

Canada has the most negative rates of any major central bank, Mexico the highest rate. Japan is now in the middle o… https://t.co/cobOQyuV4k

Bad news for the luxury sector: one thing that is not rebounding is Chinese consumer appetite for luxuries.… https://t.co/H5ow0Q5CPC

Default risk: Turkey’s CDS are now even more elevated than in 2018. Reserves low & Erdogan rules out IMF. @SoberLook https://t.co/LQNFeMW0Yp

Bad news for the luxury sector: one thing that is not rebounding is Chinese consumer appetite for luxuries.… https://t.co/c3jOWTPgLC

Default risk: Turkey’s CDS are now even more elevated than in 2018. Reserves low & Erdogan rules out IMF. @SoberLook https://t.co/GBT9JUlEoJ

It was only a matter of time: Christine Lagarde as Euro-woman, savior of the common currency. @martinwolf_… https://t.co/QiGigZpQHe

Great thread on the ECB’s response to the wave of downgrades. https://t.co/DrnzYc0PTV

Mexico’s central bank is caught in a dilemma. Its real interest rates are higher than its peers in Lat Am, but it d… https://t.co/bVI4DEW3rG

Watch this wonderful series about the history of the working class, and work! @adam_tooze https://t.co/BAazJICecK

The resurgence of smallpox and resultant pandemic in 2039 plunged the global Econ into a recession that lasted two… https://t.co/mONG1VkWHd

Pandemic crises in financial systems: a simulation-model to complement stress-testing frameworks. By Idier Julien,… https://t.co/rVUvKL1MxJ

China experienced a net capital outflow of c $19bn in March. But this is modest compared to the huge drain in 2015.… https://t.co/SJEFn5i3Z1

The huge surge in Fed purchases of Treasuries has had the effect of bringing volatility down and ensuring liquidity… https://t.co/w4JHjAC5ZI

Categories

- After the Crisis

- America's Political Economy

- Archive

- Atlantic Council

- Audio

- auf Deutsch

- Barron's

- Bloomberg

- Brexit

- Britain

- Call to Europe

- Carbon note

- Central Banking

- Centre for European Reform

- Centre Marc Bloch

- Chartbook

- Chartbook Archive

- China

- ChinaTalk

- Climate Crisis

- Climate Political Economy

- Columbia European Institute

- Corona – das Virus und die Wirtschaft

- COVID

- Crashed

- Crashed to Corona

- Critical theory

- Daily Notes

- DAVOS

- Debt Politics

- Democracy

- e-flux

- El País

- Europe

- Europe's Political Economy

- Ezra Klein

- Featured

- Financial Times

- Foreign Policy

- Forum for a New Economy

- Framing Crashed

- German Question(s)

- Germany

- Global Political Economy

- Global Political Economy

- Green Central Banking

- GZERO World

- History

- inforadio

- Intelligencer

- Internationale Politik Quarterly

- Jacobin

- JFI

- London Review of Books

- Modern History

- NBC Global Hangout

- New Left Review

- New Materialisms

- New Statesman

- New York Review of Books

- New York Times

- NOEMA

- Notes on Social Theory

- Notes on the Global Condition

- Novara Media

- Ones and Tooze

- Pin

- Politics Theory Other

- Prospect

- Reading

- RealVision

- RECET

- Response to Anderson:

- Room for Discussion

- Russo-Ukrainian War

- Scrapbook

- Shutdown

- Social Europe

- SWOP

- Talking Politics

- The Active Share

- The Drift

- The Guardian

- The Hill

- The New Yorker

- The Paper

- Top Links

- Travel

- UK

- Unhedged Exchange

- United States

- USA

- Video

- Wall Street Journal

- War in Germany

- Washington Post

- World Review

- Zeit