Spain’s recovery from the trough of 2013 is the big story of Eurozone labour markets, such as it is: https://t.co/HPdsX7XC46

Spain’s recovery from the trough of 2013 is the big story of Eurozone labour markets, such as it is: https://t.co/HPdsX7XC46

Immigrants account for 80 % of UK labour force growth since 2004. 46 % from EU https://t.co/4VTiqcAQVt

If weak $ —> growth in EM $ borrowing. What happens when $ sharply strengthens? New borrowing stops. But what about… https://t.co/thAMtFOz7U

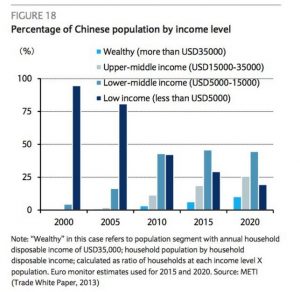

The astonishing transformation in China's social structure in the space of a generation: https://t.co/38ItBwhwvE

Russian 1914-15 #NewYear card, showing #Russia & Allies advancing to a victorious future. #history #Christmas… https://t.co/NSz5CSH0JY

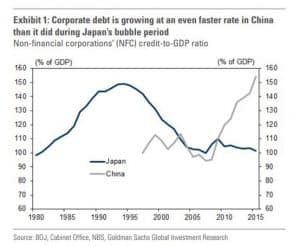

So a lot hangs on two questions: Can the Chinese econ defy gravity. If not, what happens when it falls? https://t.co/nscR1YTXDM

Europe's Political Economy (6)nEichengreen and Wyplosz's counterfactual in which Euro crisis is stopped by… https://t.co/50DRNFIIvK

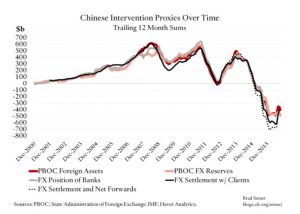

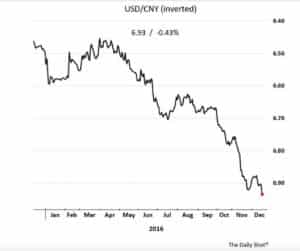

Notes on the Global ConditionnThe $-yuan exchange rate is one of the key axes of the world economy. Brad Setser… https://t.co/zOF6LHU1sF

China’s exchange rate intervention since 2000 https://t.co/b1ieclRbRs https://t.co/dXerS9wbZY

Ukraine nationalises largest lender PrivatBank with 1/3 of deposits https://t.co/mKmCQF07Al via @FT

"Risk society and the distribution of bads: theorizing class in the risk society" https://t.co/iQb1c7g9u8

1916 yılında İngiliz diplomat Mark Sykes tarafından dizayn edilen Arap İsyan bayrağından türetilmiş, günümüz Arap d… https://t.co/MLJNgF5f71

Favorite twitter trinket of the morning so far: the Morning Star's (Yup … the Morning Star's) poetry… https://t.co/UV5o1cCgFX

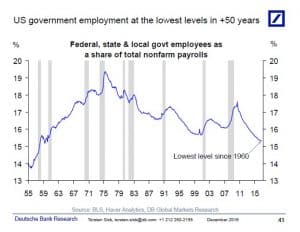

A few charts from DB'd Sløk. Share of government employees of US total payroll the lowest since 1960. https://t.co/HJzwf1yGbR

And investors haven't really cared about government debt level before, so why would they in 2018-19, Sløk asks? https://t.co/8MuPoCwW4g

The China stimulus: started November 2008 and never really stopped. The burst of new credit in early 2016 is simply… https://t.co/NOf7CL52xg

The China stimulus: started November 2008 and never really stopped. The burst of new credit in early 2016 is simply… https://t.co/rFUdu2KtQI

America's Political Economy (43)n“The American self-storage consumer is absolutely one of the most irrational… https://t.co/p1KXodBYY9

How important was the cheap $ to the world economy? We are about to find out! https://t.co/WOQwQipGyU

17 % revaluation of dollar v. yen since September! If those carry trade positions were not unwound … somebody is in… https://t.co/PHG1Q37prP

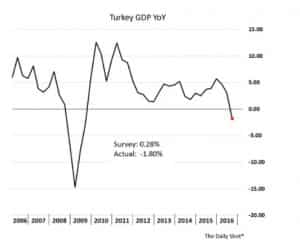

Range of US companies with large investments at risk in Turkey is pretty impressive – notably GE and Ford https://t.co/ouHBqm5nmN

<a href="https://t.co/ebp7CFsbDR" target="_blank"><img alt="Liberation"… https://t.co/Zk12yfl1xY

Tech Titans Jeff Bezos, Sheryl Sandberg Meet With Donald Trump Transition Team | Power Lunch | CNBC https://t.co/fjJA2q47xK

Staggering $650 bn surge in US overseas corporate cash pile driven by tech and Apple in particular https://t.co/Cdoba4bI0m

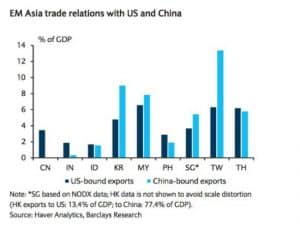

Remarkable graph showing both globalization shock to US economy and the modest role that trade has played and conti… https://t.co/422FAx4Qhe

In vulnerability to US rate hike, SA followed by Turkey where the proverbial is already hitting the fan n@TonysAngle https://t.co/MYbGo6XFAg

Our most commented-on article right now – Japanese banks warn of leaving London without Brexit clarity… https://t.co/a620emOuXm

Great German graphic on Trump’s $1.3 trn meeting with Silicon Valley: https://t.co/m0GbG9V8XE

Balance of US v. China exports for major Asian EM https://t.co/u0Hlb26JLf

Birth and death of a world order in half an hour. How's that for a lunchtime listen? @adam_tooze @FukuyamaFrancis https://t.co/7fe5etC2O2

For all the focus on deindustrialization and loss of manufacturing jobs, we dont pay enough attention to the rise… https://t.co/Cyeh7Y5NM1

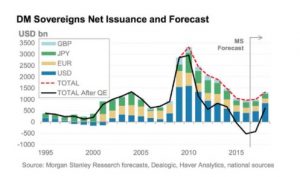

The great global public debt surge of 2009-2016: https://t.co/dxbOglOLGx

© 2025 Adam Tooze. All Rights Reserved. Privacy policy. Design by Kate Marsh.