The productivity slowdown in US economy began long before 2000 but was countervailed by the huge surge of productiv… https://t.co/h8XTCXHXwx

Archive

The doubling of Germany’s pubic debt in context of reunification 1989-1995 is decisive for the country’s political… https://t.co/9N45KxTTxj

Density of ship log entires of the major European naval powers 1750-1810. From an amazing website based on Rodrigue… https://t.co/uxLQFCAaOp

"the law of iterated fractions at work. Imports are 15% of US GDP. Apply a 10% tariff->1.5%. Allow for some substit… https://t.co/fPdlCINP4N

How container ports multiplied across the US and the rest of the world. https://t.co/cOTi7sOyLm https://t.co/WkPblNg6kW

The most all-American of vehicles, the F-Series pickup truck is assembled in Kansas City, Missouri, and Dearborn, M… https://t.co/2m44IschGw

Its not the hospitalization that kills you its the loss of income: the argument over how ill health causes bankrupt… https://t.co/pMDhft4Gjf

The evolution of cargo shipping was transformed by the advent of containerization in the 1960s.… https://t.co/1p73Y1jyFt

NAFTA’s supply chains are very deep ->74% of value of imported goods built into a car imported from Mexico to US co… https://t.co/cjvApDue9E

Btw the 1930s and 1960s admission to College in the US dramatically widened to admit talented lower income kids. Bu… https://t.co/LWbq7n8ffs

From the early 1990s the global trade in recycled and waste plastic surged, with China at the heart of a huge globa… https://t.co/elQQj9XMKQ

Coeurė addresses the problem of hegemony by invoking Maas: "Our response to “America first” can therefore only be “… https://t.co/hY0UrjRlsN

Global assets: The association between Chinese credit cycle and house prices in Sydney and London is striking!… https://t.co/cONK9a9SJW

Radical change is possible. The mistake to let the car dominate public space can be fixed. ~Maliesingel, Utrecht https://t.co/mWbhfKl5Ng

Household and non financial corporate credit creation in the big three: US, China and EU. Data from Matt King of Ci… https://t.co/mOAbGlSDV4

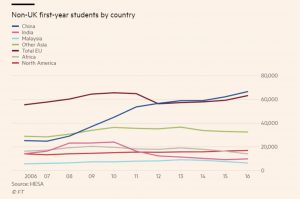

Since 2012 Chinese students have outnumbered EU in UK higher education. https://t.co/Y7T11NtUiz https://t.co/TGBB7nHi1s

The global recycling of collateral through rehypothecation is seeing a rebound from the post-crisis lows! Great to… https://t.co/A7VgPSAZXT

“we are in the last throes of this cycle, and we expect the miners to take the first tentative steps towards growth… https://t.co/PJyDMadkdi

"The major miners are well-positioned to absorb a potential external shock after completing their debt reduction pl… https://t.co/x5LbaP9ZVo

"And that is where the US finds itself: a societal cognitive dissonance that threatens to drown out all reasonable… https://t.co/9taLzd3UxZ

Ginne Mae is now at heart of America’s mortgage securitization system. Nonbank lenders are back in force and Ginnie… https://t.co/kwRdbwrTaG

What happens in a crisis! How the warehouse funding that underpins “nonbank” mortgage business in US collapsed in 2… https://t.co/eml8tIkSH6

Mortgage shadow banking in the US is back to precrisis levels. Nonbanks accounted for 50 % of all mortgage originat… https://t.co/LO68gTLQnH

“Warehouse finance” is the main means of short-term funding for nonbank mortgage providers backstopped by Ginnie Ma… https://t.co/gYWNxc3OVk

Still broken: 50 % of US mortgages in 2017 were provided by fragile “nonbanks" backstopped by GinnieMae and funded… https://t.co/aadKk0Q8ZI

The needle is moving. Support for Germany spending 2% by 2024 now up to 45%. That is a significant shift. Remarkab… https://t.co/9CspZZIviX

The financial industry has been remarkably successful at persuading investors to pay a steady fee for its services… https://t.co/EyI2d85teS

The dispersion in state spending on higher education across the US is spectacular. @howmuch_net @SoberLook https://t.co/2bzlcrs2V9

The ratio of Black to White median income in US rose from 58% to 64% btw 1970 and 2016 but at the $200k+ threshold… https://t.co/C4o09sKkEi

The real hubs of “global trade” are regional -> puts risks of trade wars with America in perspective … unless you a… https://t.co/FJi8Fuov7r

Explosion in US fixed income supply combined with Eurozone QE tapering is going to test markets. It will be surpris… https://t.co/X18b4pFhYO

Number of people who go bankrupt every year because of medical bills: Britain – 0 France – 0 Germany – 0 Netherlan… https://t.co/Kex7SLn8Jl

Foreign investors now hold 30% of US corporate debt – comparable to share of subprime securitization they held befo… https://t.co/aJWBf6ZhZC

Not only are tightening labour markets in the US producing only modest wage growth, in real terms, wages are actual… https://t.co/WZFKahSmE2

Ahead of trade war in which it cannot absolutely cut its dependence on the US, China is laying in the soya stocks.… https://t.co/rdebaK0mm8

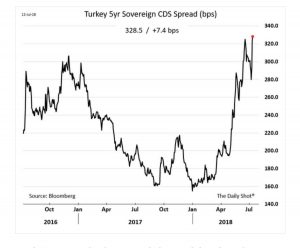

Rumors that Turkey will impose capital controls to stem capital flight are worrying markets. @SoberLook https://t.co/bxpXMJYoC0

Categories

- After the Crisis

- America's Political Economy

- Archive

- Atlantic Council

- Audio

- auf Deutsch

- Barron's

- Bloomberg

- Brexit

- Britain

- Call to Europe

- Carbon note

- Central Banking

- Centre for European Reform

- Centre Marc Bloch

- Chartbook

- Chartbook Archive

- China

- ChinaTalk

- Climate Crisis

- Climate Political Economy

- Columbia European Institute

- Corona – das Virus und die Wirtschaft

- COVID

- Crashed

- Crashed to Corona

- Critical theory

- Daily Notes

- DAVOS

- Debt Politics

- Democracy

- e-flux

- El País

- Europe

- Europe's Political Economy

- Ezra Klein

- Featured

- Financial Times

- Foreign Policy

- Forum for a New Economy

- Framing Crashed

- German Question(s)

- Germany

- Global Political Economy

- Global Political Economy

- Green Central Banking

- GZERO World

- History

- inforadio

- Intelligencer

- Internationale Politik Quarterly

- Jacobin

- JFI

- London Review of Books

- Modern History

- NBC Global Hangout

- New Left Review

- New Materialisms

- New Statesman

- New York Review of Books

- New York Times

- NOEMA

- Notes on Social Theory

- Notes on the Global Condition

- Novara Media

- Ones and Tooze

- Pin

- Politics Theory Other

- Prospect

- Reading

- RealVision

- RECET

- Response to Anderson:

- Room for Discussion

- Russo-Ukrainian War

- Scrapbook

- Shutdown

- Social Europe

- SWOP

- Talking Politics

- The Active Share

- The Drift

- The Guardian

- The Hill

- The New Yorker

- The Paper

- Top Links

- Travel

- UK

- Unhedged Exchange

- United States

- USA

- Video

- Wall Street Journal

- War in Germany

- Washington Post

- World Review

- Zeit