The household deleveraging in the Eurozone in the countries hit worst by the crisis of 2008 and after has been cons… https://t.co/eBCw7JT0dO

Archive

Real hourly compensation numbers with all the trimmings from @econjared https://t.co/7yCWzbQAlt https://t.co/N47c7HbRRm

“Chinese investors tend to be momentum driven, while foreign investors tend to be contrarian.”… https://t.co/fSITWdADgH

No real wages in US really aren’t rising: Devastating rebuttal by @econjared to efforts by Trump’s CEA to massage r… https://t.co/y0295NOa3b

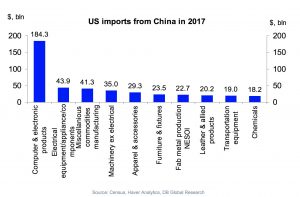

American imports from China consists overwhelmingly of electronics. https://t.co/V21BDfVHAy

“For past 20 years, however, we have had a series of wealth bubbles – first the Dot-Com bubble, then the Housing Bu… https://t.co/qZWilheMvZ

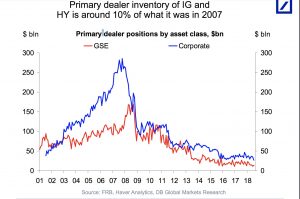

Primary dealer inventory of IG and HY fixed income assets is around 10% of what it was in 2007 https://t.co/FE6Pje48rA

Q1: 2018 US corporations “onshored” $300bn of expat profits. As Fed comments: "repatriation reflects the transfer o… https://t.co/u5t0Ifufb1

The surge in emerging market non financial corporation debt is driven almost entirely by China.… https://t.co/dfgyi22u0K

"The Manchuria region of 120 million residents remains plagued by deep-rooted economic ills, including the continue… https://t.co/rjVf8qGy3U

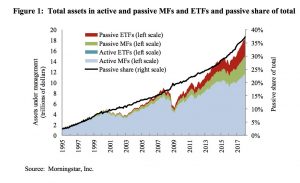

Btw 1995 and 2018 assets in MF and ETF surge from $2trn to $18trn. https://t.co/gUY1VIHHK1

Having invested in a blow dry before I get on the @ftmoney stage, it had better not rain! Come and meet @MerrynSW… https://t.co/sCFyOcgIXM

In past EM dependence on $funding has come with the sweetener of steady US import demand. The current US policy mix… https://t.co/I0XYt7hXTJ

The distribution of US labour by occupation and hourly wage rate. @DeutscheBank Torsten Slok. https://t.co/lBrLFlqcuw

"the world is “short” roughly $11.5trn, compared to $3.5trn worth of euros and $0.39trn of Japanese yen”… https://t.co/KlRqlHhB7h

Employment trends in US since 2008 diverged starkly by educational level: 13m increase in employment of BA grads v.… https://t.co/T0EW6TJpx6

Welfare states DO make a difference but most of the difference in post-tax gini btw Norway and US is explained by l… https://t.co/ftLo9pNJkH

Employment trends in service sector and goods producing industries in US have dramatically diverged. @DeutscheBank… https://t.co/HpAZMeJoeD

Since the early 2000s UK growth has been extensive i.e. driven not by productivity increase but by adding workers,… https://t.co/HRTu4zPiaW

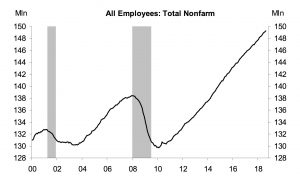

Total employment in the US at an all time high of 149 m. @DeutscheBank Torsten Slok https://t.co/2DB3rxPWoN

'While Argentina and Turkey are big standalone stories, I am not sure we can claim that EM is heading for a systemi… https://t.co/1C8qFS2PHD

In 2009 BlackRock’s acquisition of iShares was indicative of shifting balance of power on Wall Street to the buy s… https://t.co/xR8JUzu4pB

@groys @nytimes this is Geithner’s mantra. He at times even seems to suggest that whether something is truly unpopu… https://t.co/wjR3Hh6Oeh

However it started out, NAFTA hardly looks like an elite conspiracy now. A majority of US citizens support it. Mexi… https://t.co/iQKCIsrvuI

US has been running a modest trade surplus with Canada on a huge volume of trade. But can anyone tell me what happe… https://t.co/GkiUXXR41X

The restriction to hold profits overseas was meaningless to corporate treasurers as long as they could borrow again… https://t.co/6bnvzjvBa9

Quantitative tightening is now adding up to real numbers: Fed balance sheet down $260bn since peak. @SoberLook https://t.co/TWYS4nvwpV

Tariffs have little relationship to current account balance, but what does is the savings-investment gap. In fact C… https://t.co/tf8JYZ8jWz

Big chunks of US consumer population are worrying about tariffs … so are the vast majority of producers. @SoberLook… https://t.co/OJD6A8lEvE

If for sake of argument we treat the EU and US as analogous economic units -> degree of trade openness of UK, Franc… https://t.co/NZFwrQkfQB

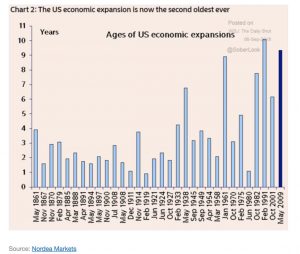

The current US economic expansion is the 2nd longest in history. @NordeaMarkets @SoberLook https://t.co/4nYFZhVfDY

Useful chart reminder of the three global regimes of debt: high public debt – Japan (Italy); high household debt -… https://t.co/CjFapopYiB

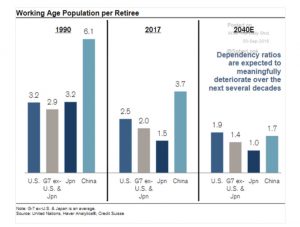

China’s dependency ratio by 2040 could be worse than that of the US. @SoberLook @CreditSuisse https://t.co/qZ9hKLY2fH

Categories

- After the Crisis

- America's Political Economy

- Archive

- Atlantic Council

- Audio

- auf Deutsch

- Barron's

- Bloomberg

- Brexit

- Britain

- Call to Europe

- Carbon note

- Central Banking

- Centre for European Reform

- Centre Marc Bloch

- Chartbook

- Chartbook Archive

- China

- ChinaTalk

- Climate Crisis

- Climate Political Economy

- Columbia European Institute

- Corona – das Virus und die Wirtschaft

- COVID

- Crashed

- Crashed to Corona

- Critical theory

- Daily Notes

- DAVOS

- Debt Politics

- Democracy

- e-flux

- El País

- Europe

- Europe's Political Economy

- Ezra Klein

- Featured

- Financial Times

- Foreign Policy

- Forum for a New Economy

- Framing Crashed

- German Question(s)

- Germany

- Global Political Economy

- Global Political Economy

- Green Central Banking

- GZERO World

- History

- inforadio

- Intelligencer

- Internationale Politik Quarterly

- Jacobin

- JFI

- London Review of Books

- Modern History

- NBC Global Hangout

- New Left Review

- New Materialisms

- New Statesman

- New York Review of Books

- New York Times

- NOEMA

- Notes on Social Theory

- Notes on the Global Condition

- Novara Media

- Ones and Tooze

- Pin

- Politics Theory Other

- Prospect

- Reading

- RealVision

- RECET

- Response to Anderson:

- Room for Discussion

- Russo-Ukrainian War

- Scrapbook

- Shutdown

- Social Europe

- SWOP

- Talking Politics

- The Active Share

- The Drift

- The Guardian

- The Hill

- The New Yorker

- The Paper

- Top Links

- Travel

- UK

- Unhedged Exchange

- United States

- USA

- Video

- Wall Street Journal

- War in Germany

- Washington Post

- World Review

- Zeit