If copper is the commodity with the econ phd, does the recent upturn suggest an EM recovery. @colbyLsmith investiga… https://t.co/gi4nfmHknK

Archive

"simplicity is not original; on the contrary, it is the structured whole which gives its meaning to the simple cate… https://t.co/8rL9q5VPSJ

Whatever shape the US may be in, the bald Eagle is doing well! In 1963 there were only 487 nesting pairs in mainlan… https://t.co/OLpybXBXm6

As the eurozone’s QE reaches high tide, the flow of european money into US debt reverses for the first time since 2… https://t.co/sOOsPt9P30

Lower-skilled, lower-earning workers who have the least resources to adjust are the most vulnerable to automation.… https://t.co/B7GzxXghzU

"Mexico folded under pressure, leaving Canada in the lurch — the target of unilateral tariffs — until Ottawa, too,… https://t.co/uskZRsZN2Q

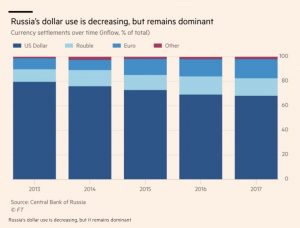

Russia talks about dedollarizing, but almost 70% of its trade is still denominated in $. https://t.co/vqoDUyKOtD https://t.co/XqCB4KRbOS

Strikingly Turkey and Argentina, the current EM crisis cases, are in small group that saw debt/gdp fall since the c… https://t.co/Vf2AUo3Vyq

"could one at least diminish Trump’s symbolic victory in Nafta’s new name? If we can be allowed a little anagrammat… https://t.co/R3ksDZBp7w

This EM risk board by @NordeaMarkets has Chile’s risk level ahead of Turkey, and Israel level pegging. Hardly plau… https://t.co/ShQnC48gWN

"Turkey’s finance minister has blamed “opportunism and stockpiling” for a soaring rate of inflation that reached al… https://t.co/N4Qr98XsXV

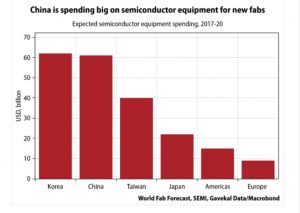

Expansion of China’s semiconductor industry means it can now supply 1/3 of its huge consumption from domestic produ… https://t.co/18ekoSh9Cn

Cambridge University’s POLIS is pulling together a fantastic group of people involved in IR, theory and History. Fo… https://t.co/z0KNPX2fNG

Korea and China are outspending US on chip production facilities by 4:1, 6:1 v Europe. @SoberLook @Gavekal https://t.co/67Qk0UWF1Q

"To be fair to Lebanon … Its finances have long defied logic and it has never defaulted on its debt, even when it… https://t.co/7Tl1abwDFN

"complexly-structurally-unevenly determined. I must admit, I preferred a shorter term: overdetermined” – Louis Alth… https://t.co/GwhR6FSbfa

France’s debt/gdp ratio has stabilized at 100% up from 65% before the crisis. @SoberLook https://t.co/fzK6tB83QH

Spanish banks need Turkey’s banks to stay solvent. @colbyLsmith dissects the @BIS_org data on bank entanglement wit… https://t.co/At1tC3hinz

American farmers are stockpiling soy in the hope that the trade war goes away and prices recover. @SoberLook… https://t.co/UR7HX8OySI

"the terms, … still fall short of providing Puerto Rico with a clear path back to debt sustainability” @Brad_Setser… https://t.co/XAXZ6kPTo5

It is not just the level of US gov debt issuance but the heavy reliance on short-term bills that is noteworthy abou… https://t.co/GiiwX2BTB1

Nice summary of the key signposts for Italy's budget, from Kate Allen @FT. https://t.co/YUZcQ3se5e https://t.co/ONu2evu7Q4

That feeling when the excellent @Noahpinion recommends your feed and you gain 600 followers in a couple of hours! a… https://t.co/6SrnPgYTIH

Stealth stimulus? Trump’s infrastructure program? Relatively buoyant local budgets? Dumb luck? Ahead of 2018 midter… https://t.co/fRS0ovqApf

Growth in public construction in the US currently exceeds growth in private sector. Are we reaching peak of cycle?… https://t.co/aZ9lbh6jes

Slowdown in growth in wages in EM post-2008 was even more dramatic than in rich countries. Fascinating from IIF’s… https://t.co/1lDGNVfgiQ

Back to the 1980s corporate debt levels spiked in recessions along with default rates. Currently the debt level is… https://t.co/iXydGZcgaj

How badly would a hard landing scenario in which Chinese growth falls to 2% with significant financial squeeze impa… https://t.co/JtEUo1yD14

. @adam_tooze has noted that the bulk of foreign inflows into the US over the last five years have gone into corpor… https://t.co/dubcDG4a8m

If China grows more slowly, how much does that affect global commodity prices? ECB paper estimates: 5% drop for oil… https://t.co/t3KJF1Lr1C

There is $4 trillion in foreign investment in US corporate debt! @Gavekal @SoberLook As @Brad_Setser has argued thi… https://t.co/rFqSCSAFrc

Exposure to China measured in terms of value added absorbed by Chinese final demand, varies from 10% for Taiwan to… https://t.co/5c5Po6xV9n

Here comes Erdogan’s recession: Turkish industrial production and PMI plunging at rates not seen since 2008.… https://t.co/wPEPq4v3xe

Though China is slowing down its greater size means that it now accounts for c. 30% of global growth.… https://t.co/wv95O6WvVw

The gear shift in China’s economy in early 2017 comes out clearly from this graph: After the binge from 2008-2010 a… https://t.co/phYLvqWM5u

Japan, Spain and now China have all had ratios of credit to the non-private sector to GDP topping 200%. It hasn’t e… https://t.co/soPc58qwo2

Categories

- After the Crisis

- America's Political Economy

- Archive

- Atlantic Council

- Audio

- auf Deutsch

- Barron's

- Bloomberg

- Brexit

- Britain

- Call to Europe

- Carbon note

- Central Banking

- Centre for European Reform

- Centre Marc Bloch

- Chartbook

- Chartbook Archive

- China

- ChinaTalk

- Climate Crisis

- Climate Political Economy

- Columbia European Institute

- Corona – das Virus und die Wirtschaft

- COVID

- Crashed

- Crashed to Corona

- Critical theory

- Daily Notes

- DAVOS

- Debt Politics

- Democracy

- e-flux

- El País

- Europe

- Europe's Political Economy

- Ezra Klein

- Featured

- Financial Times

- Foreign Policy

- Forum for a New Economy

- Framing Crashed

- German Question(s)

- Germany

- Global Political Economy

- Global Political Economy

- Green Central Banking

- GZERO World

- History

- inforadio

- Intelligencer

- Internationale Politik Quarterly

- Jacobin

- JFI

- London Review of Books

- Modern History

- NBC Global Hangout

- New Left Review

- New Materialisms

- New Statesman

- New York Review of Books

- New York Times

- NOEMA

- Notes on Social Theory

- Notes on the Global Condition

- Novara Media

- Ones and Tooze

- Pin

- Politics Theory Other

- Prospect

- Reading

- RealVision

- RECET

- Response to Anderson:

- Room for Discussion

- Russo-Ukrainian War

- Scrapbook

- Shutdown

- Social Europe

- SWOP

- Talking Politics

- The Active Share

- The Drift

- The Guardian

- The Hill

- The New Yorker

- The Paper

- Top Links

- Travel

- UK

- Unhedged Exchange

- United States

- USA

- Video

- Wall Street Journal

- War in Germany

- Washington Post

- World Review

- Zeit